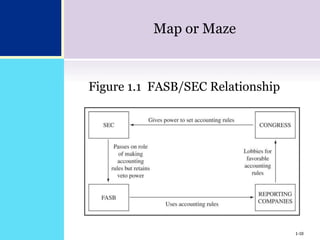

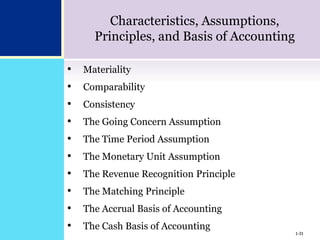

The document provides an overview of financial statements, discussing their dual nature as both a map and a maze, where they can clarify a firm's financial health or confuse users with complexity. It outlines the main objectives of the course, which include ensuring financial statements are comprehensible, demonstrating analysis techniques, and promoting informed decision-making. Additionally, it explains key financial documents, auditing types, reporting reforms, and the importance of management discussions in providing a clearer financial picture.