Embed presentation

Downloaded 93 times

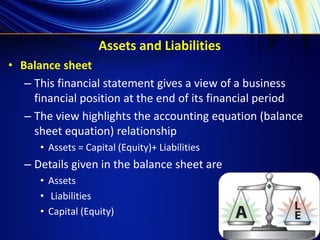

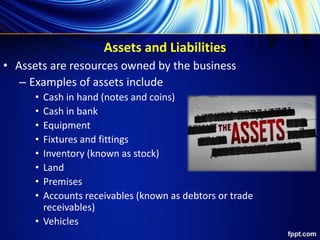

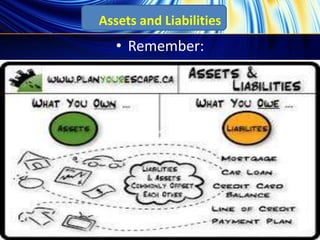

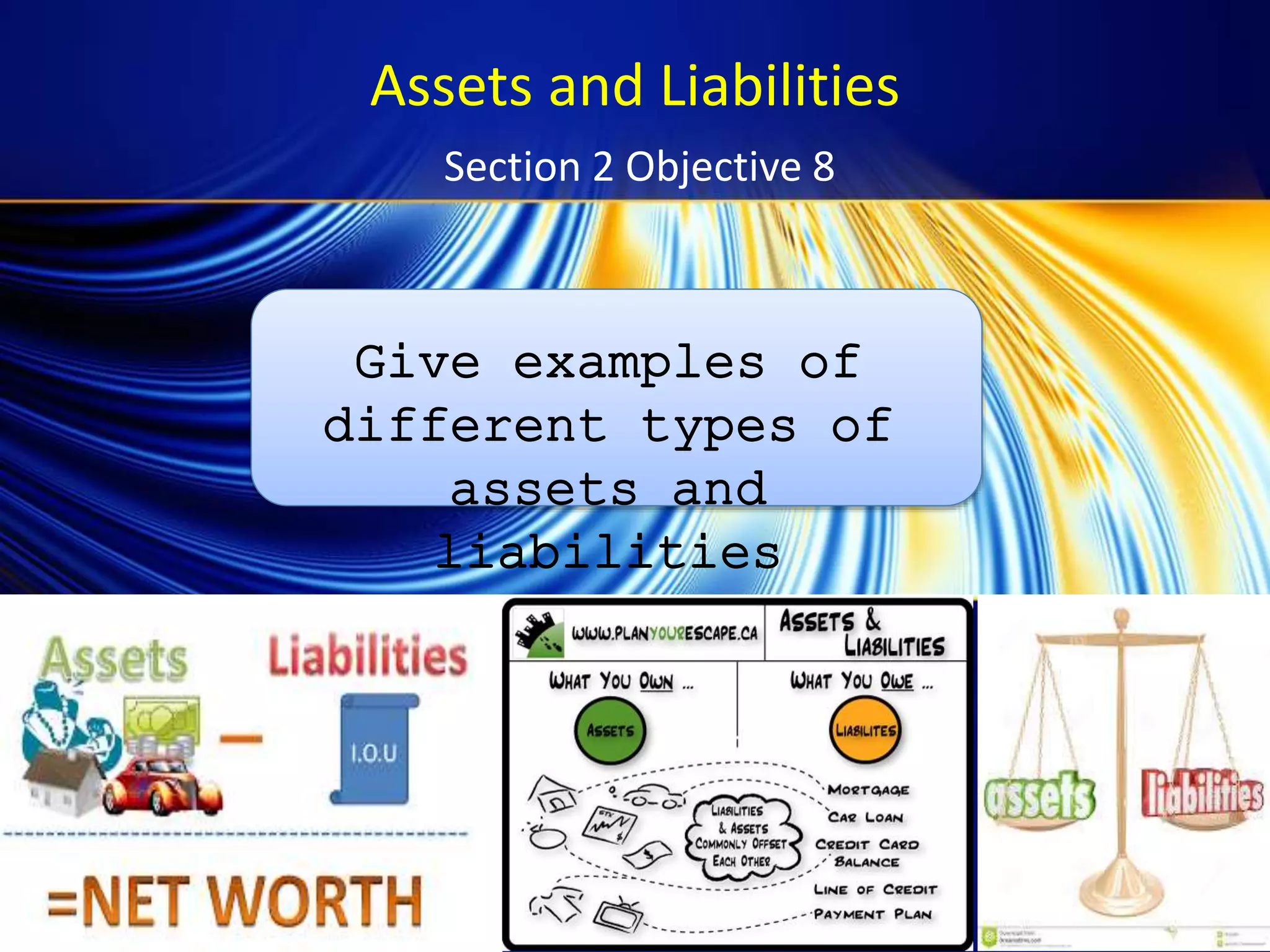

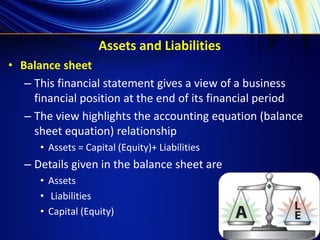

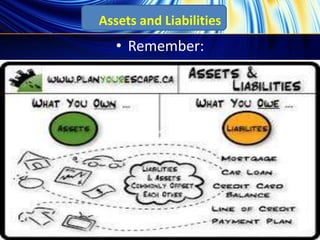

The document defines assets and liabilities according to a business's balance sheet. Assets are resources owned by the business, such as cash, equipment, inventory, and property. Liabilities are amounts owed, including loans, overdrafts, and unpaid expenses. The accounting equation shows that assets equal liabilities plus equity/capital invested in the business. Examples are given of common assets and liabilities to consider when starting a barber shop or beauty salon business.