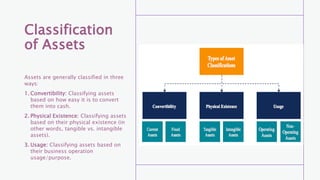

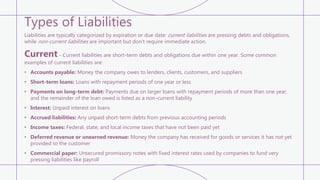

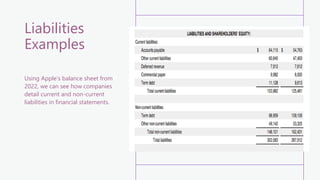

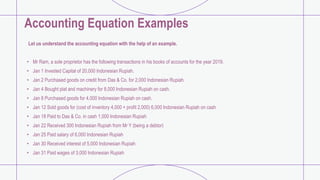

The document outlines the definitions and classifications of assets and liabilities according to the International Financial Reporting Standards (IFRS). Assets are categorized based on convertibility, physical existence, and usage, while liabilities are divided into current and non-current types based on their due dates. Additionally, the document discusses the accounting equation (assets = liabilities + shareholder equity) and illustrates these concepts with examples and the role of contingent liabilities in financial reporting.