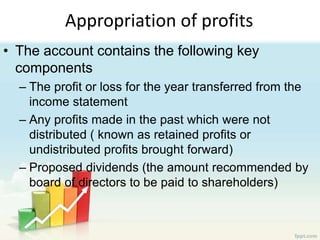

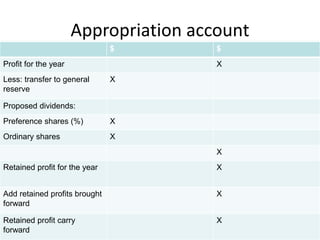

The document discusses the appropriation of profits process for a limited liability company. It explains that net profits are transferred to an appropriation account rather than share capital accounts. The appropriation account is used to allocate profits between dividends, reserves, and retained earnings. It contains key items like the profit/loss for the year, retained profits brought forward, proposed dividends, transfers to reserves, and retained profits carried forward. The document also distinguishes between capital reserves, which are not used for dividends, and revenue reserves, which can be used for dividends. An example appropriation account is provided.