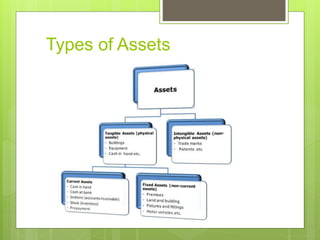

This document defines and categorizes assets, liabilities, and capital for businesses. Assets are property that can be converted to cash, including premises, land, equipment, and cash holdings. Assets are either tangible physical items or intangible non-physical items. They are also current assets meant to be converted to cash within a year, or fixed assets used longer-term. Liabilities are debts or obligations like loans, overdrafts, and expenses. Liabilities can be short-term obligations due in under a year, or long-term obligations due in over a year. Capital refers to the monetary resources owed to the business owner from starting funds, expansions, and retained profits.