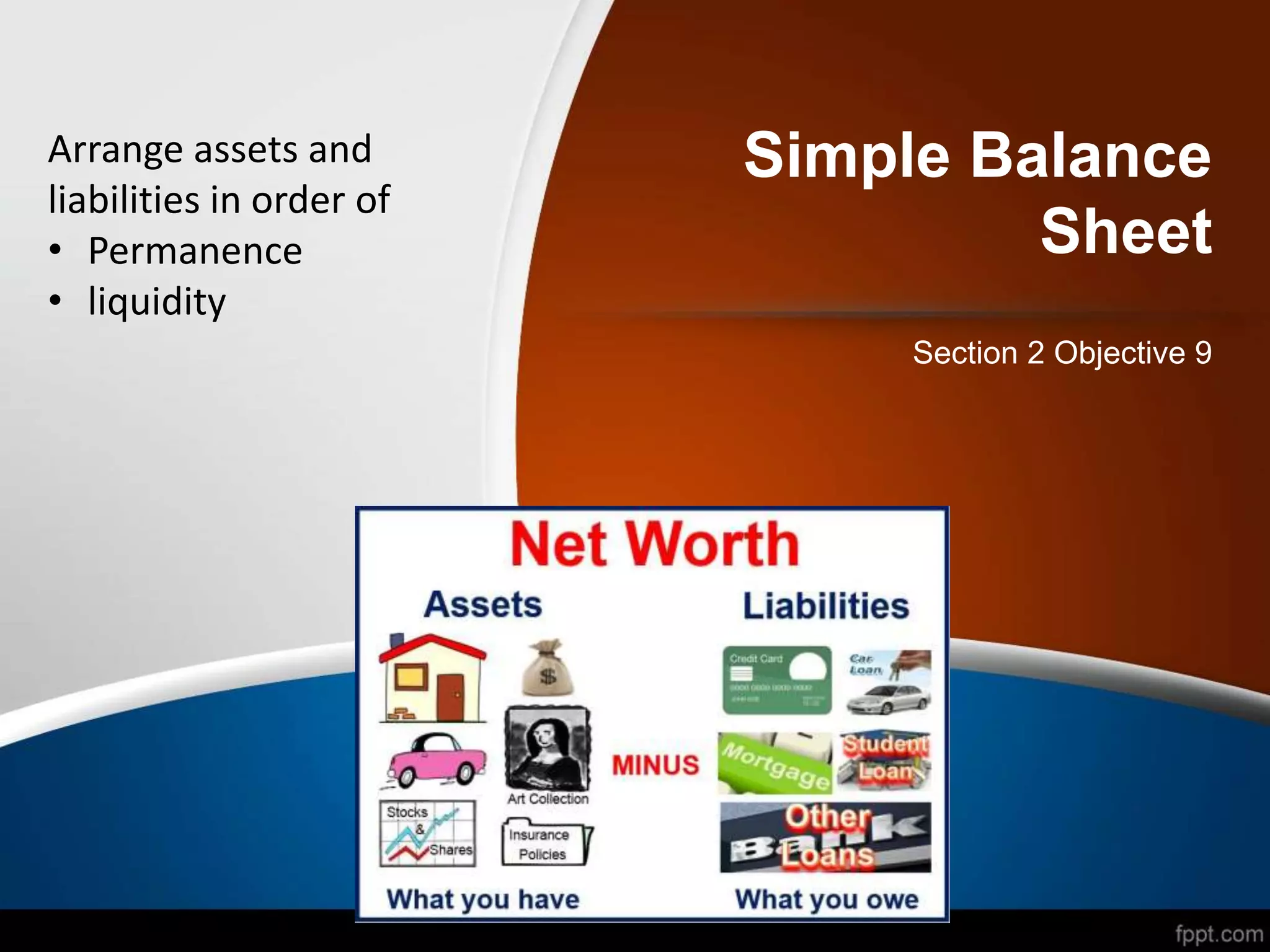

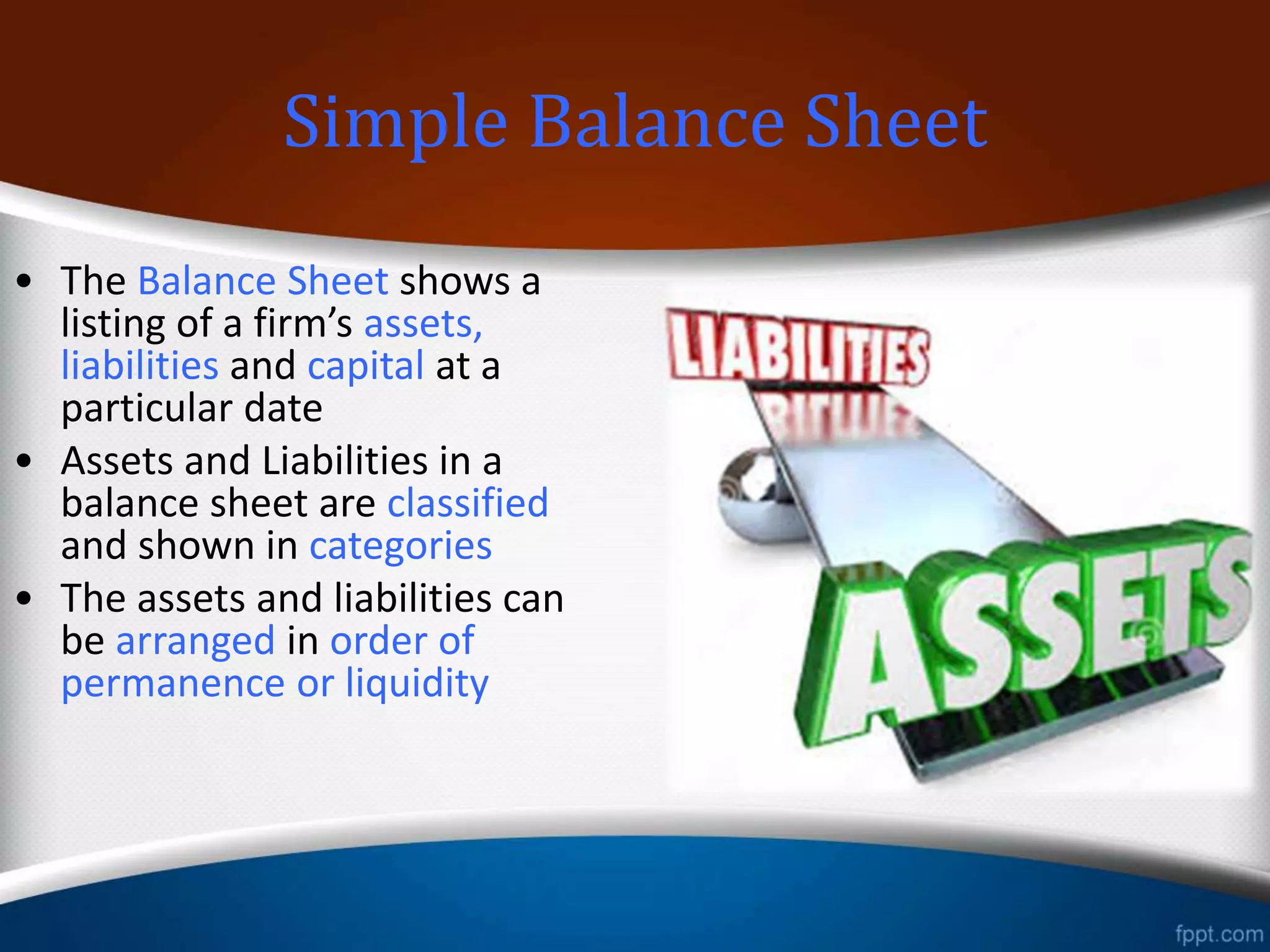

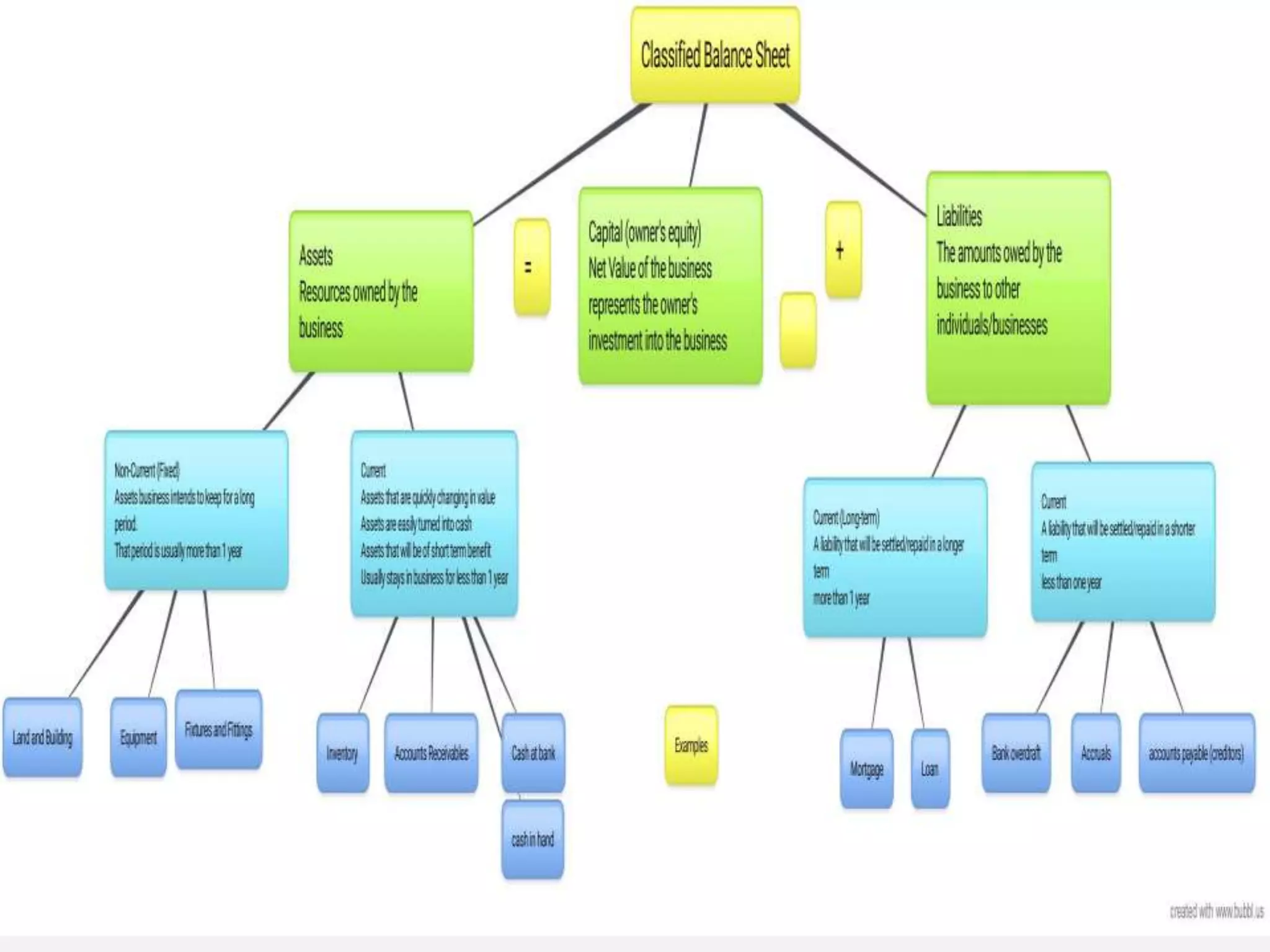

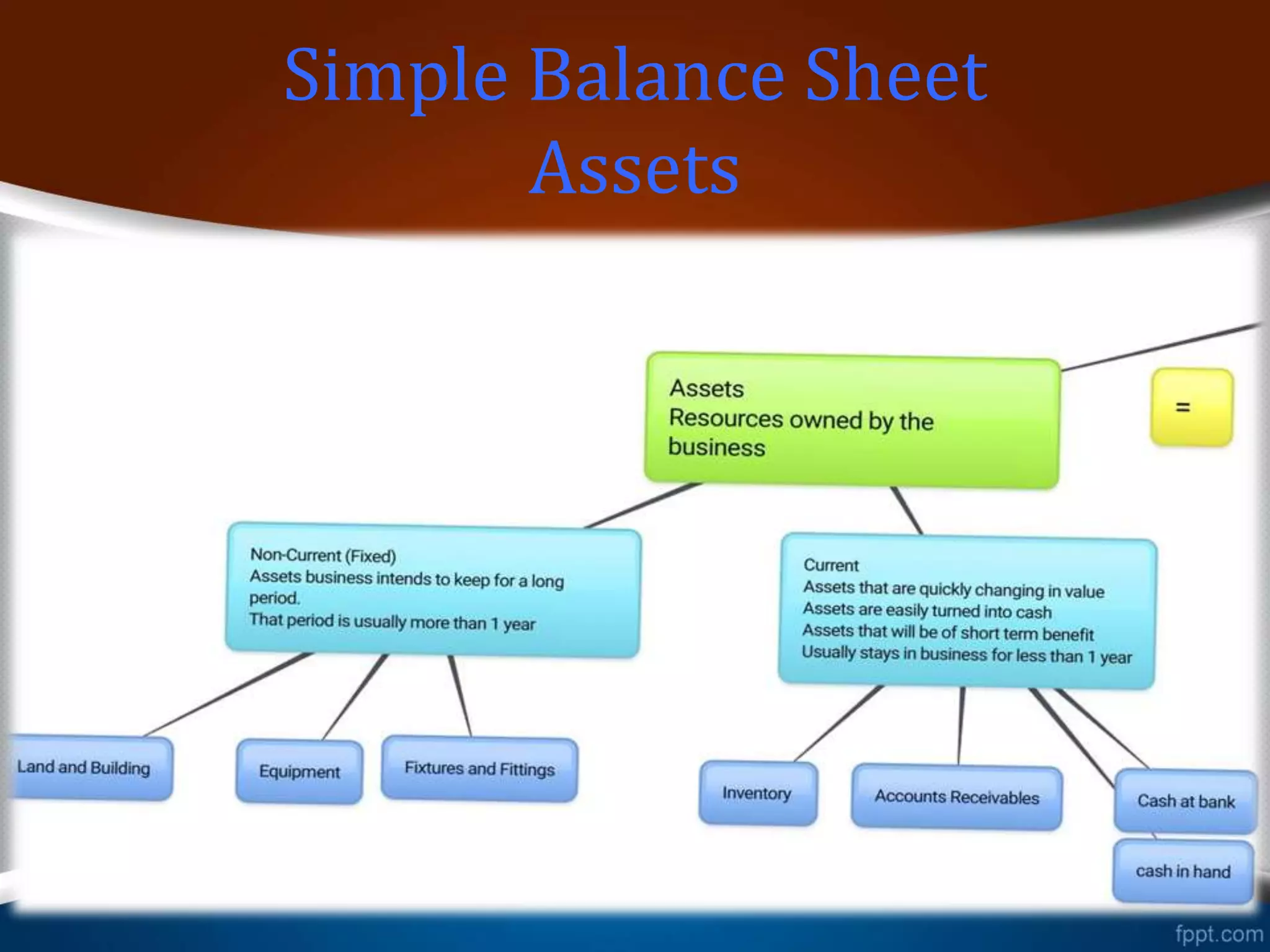

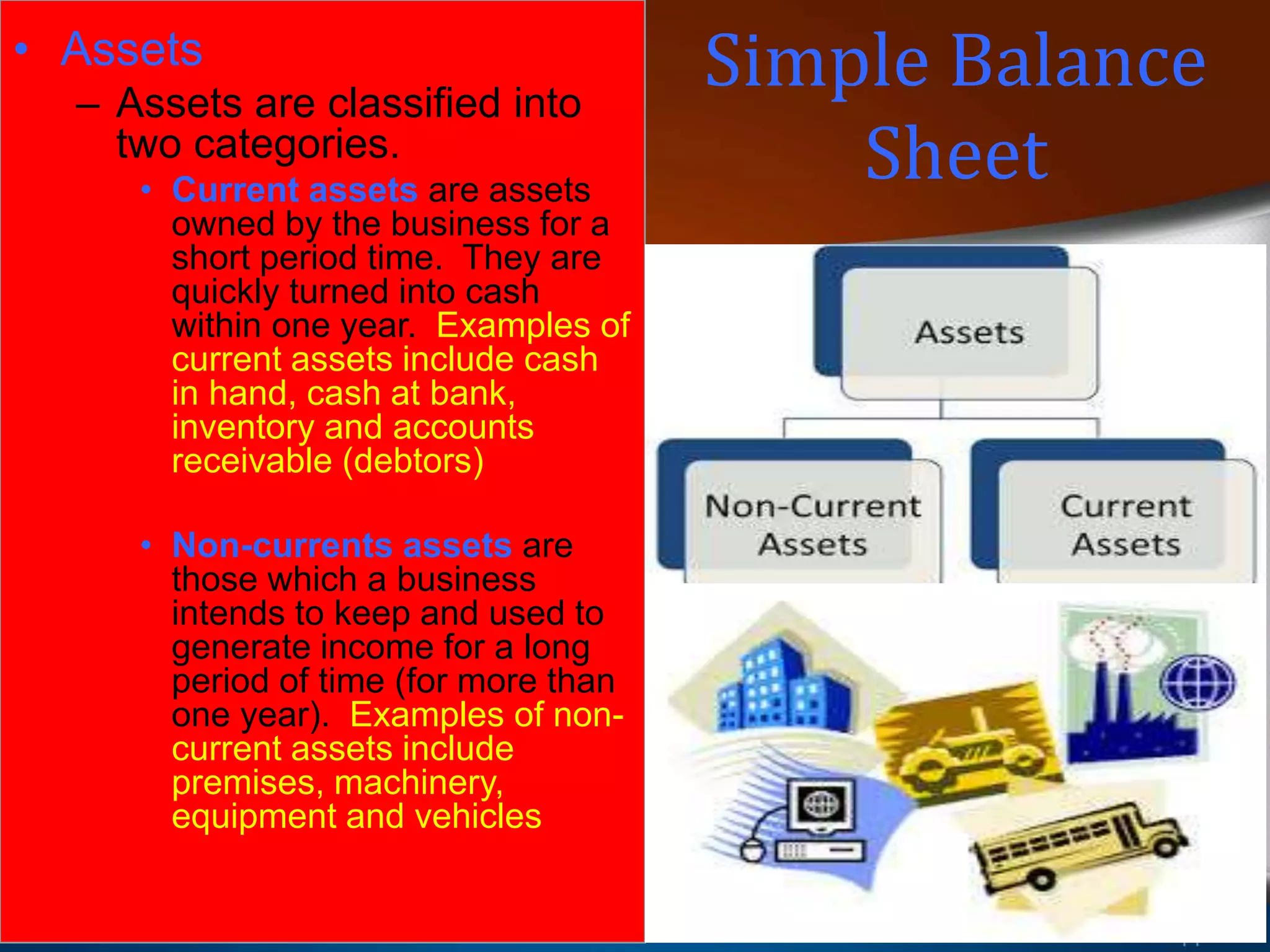

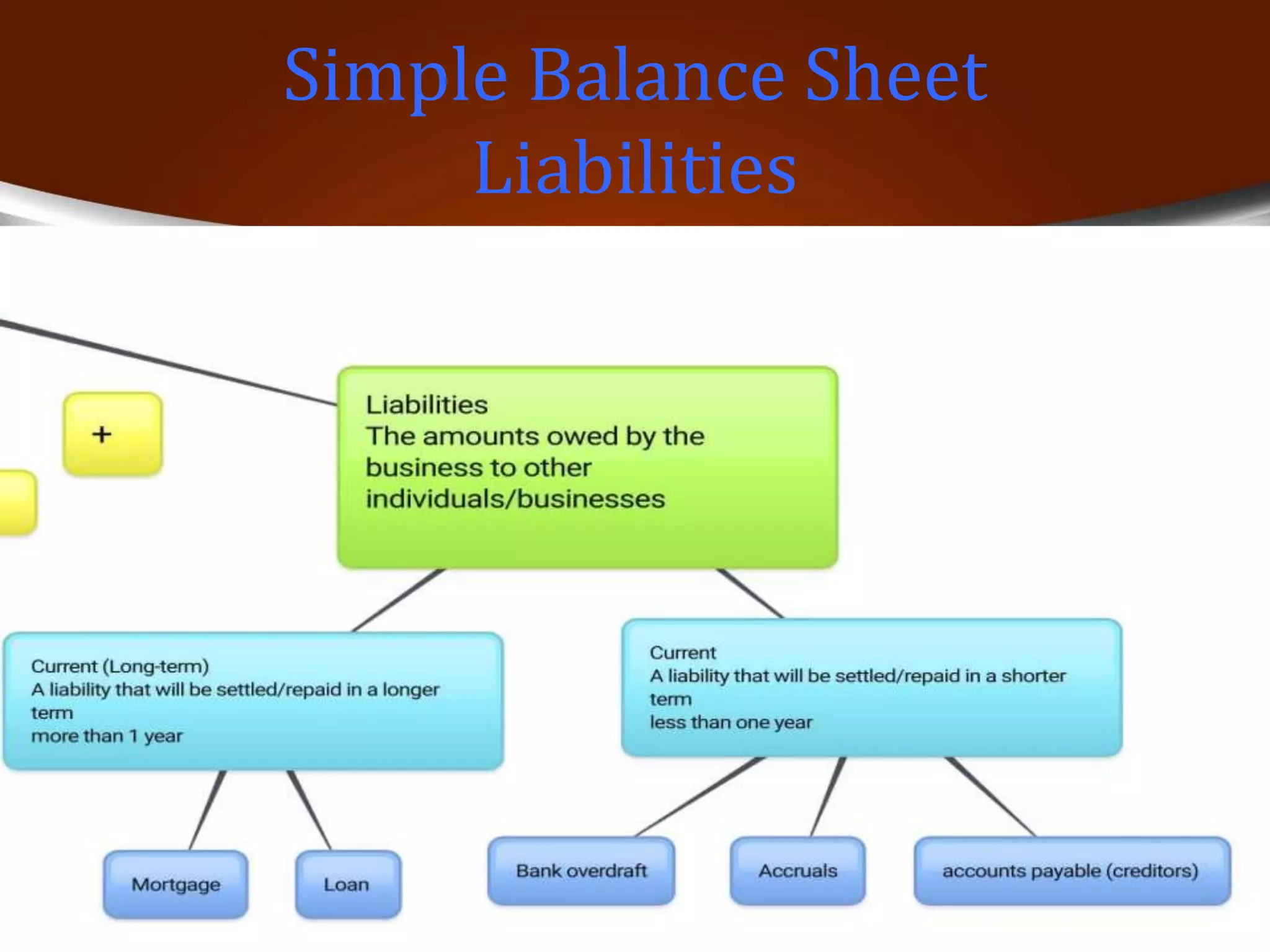

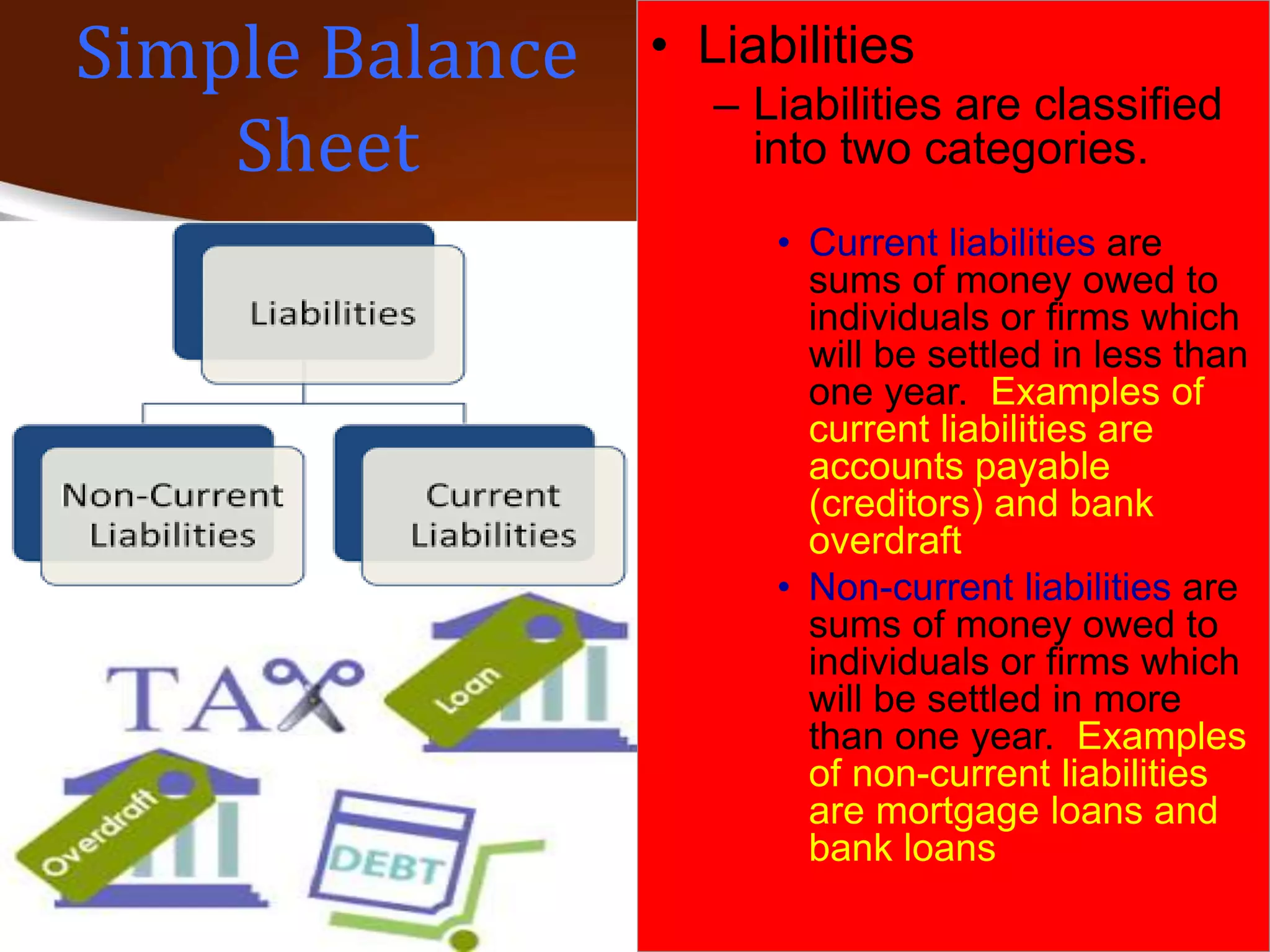

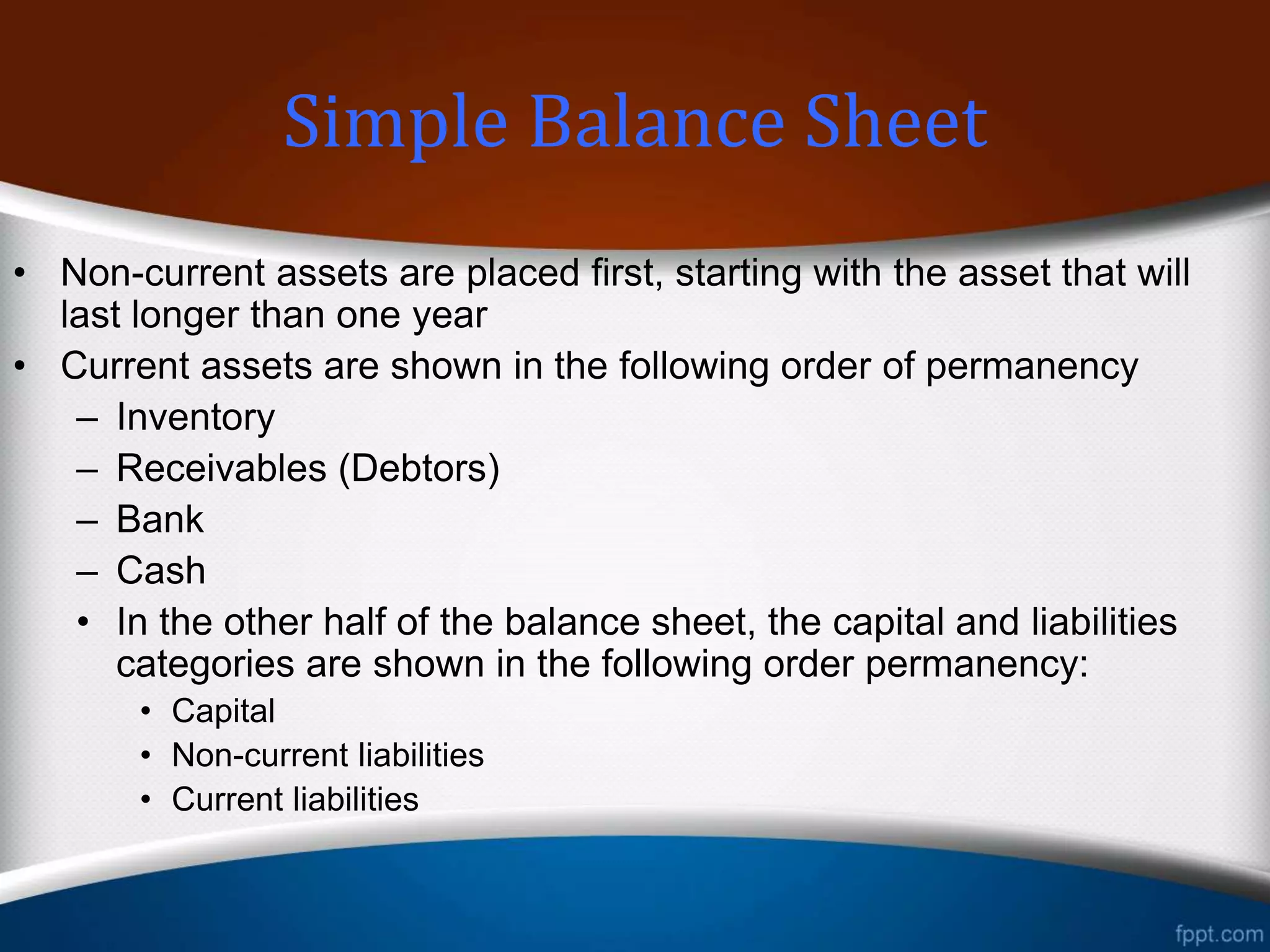

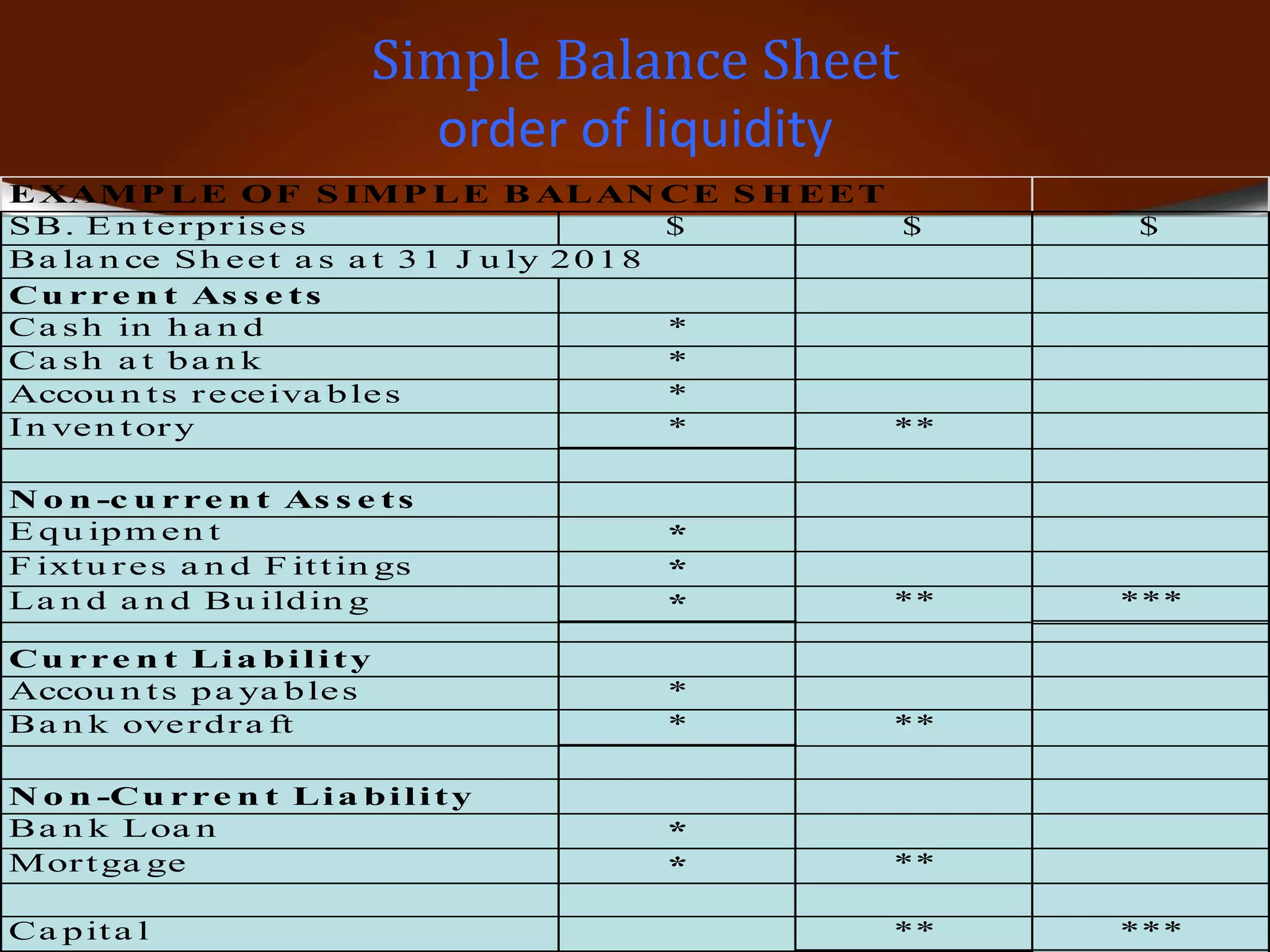

The document discusses how to prepare a classified balance sheet. It explains that assets and liabilities should be classified and arranged in order of either permanence or liquidity. Current assets are those expected to be converted to cash within one year, while non-current assets will provide long-term benefits. Similarly, current liabilities are due within one year and non-current liabilities are long-term debts. The document provides examples of common asset and liability line items and demonstrates how they would be arranged in the two styles of a classified balance sheet.