Embed presentation

Downloaded 133 times

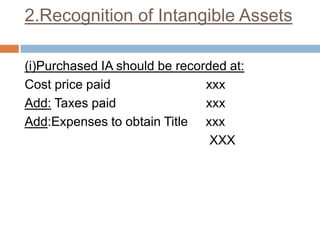

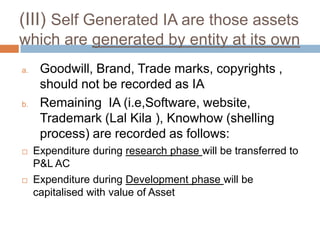

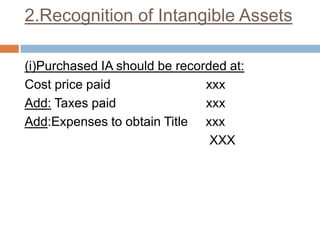

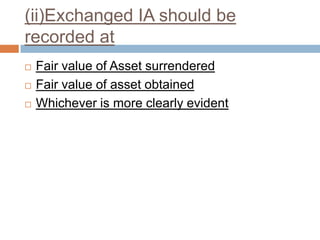

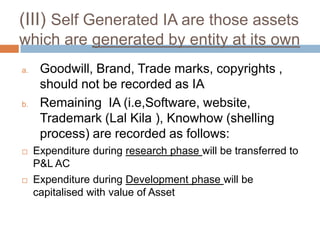

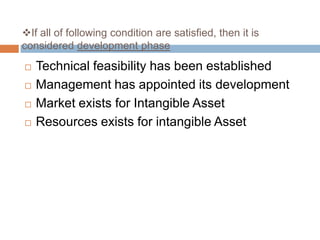

Intangible assets are non-physical assets that provide future economic benefits such as goodwill, patents, trademarks, and software. Examples of intangible assets include goodwill, patents, knowhow, trademarks, and software/websites. Preliminary expenses, advertisement suspense accounts, and other deferred revenue expenditures are not considered intangible assets. Purchased intangible assets should be recorded at cost, while exchanged intangible assets should be recorded at the fair value of the asset surrendered or received, whichever is more evident. Self-generated intangible assets capitalize development expenditures once technical feasibility and intent to complete have been established. Intangible assets should be amortized in a manner consistent with the