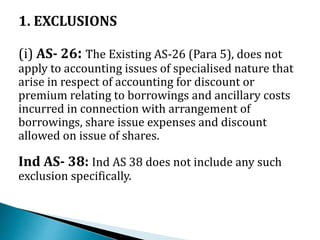

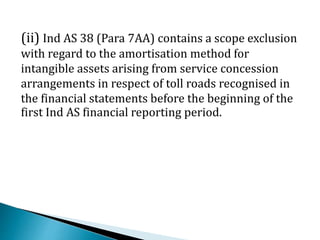

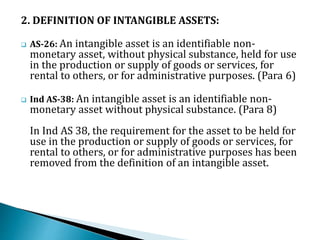

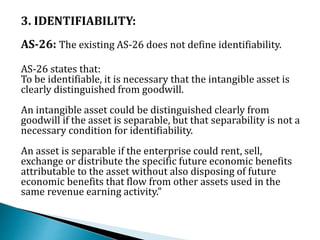

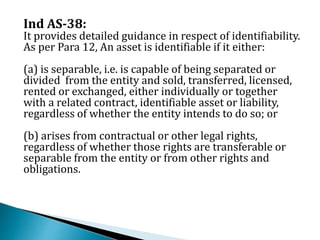

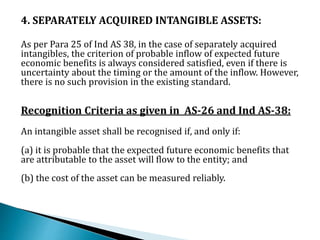

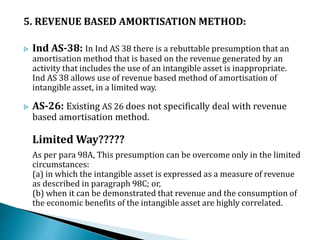

The document compares the accounting treatment of intangible assets under Indian Accounting Standard 38 (Ind AS 38) and the existing Accounting Standard 26 (AS 26).

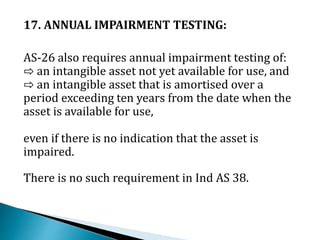

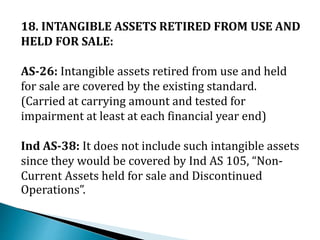

Some key differences highlighted are: (1) Ind AS 38 provides more detailed guidance around identifiability, amortization methods including revenue-based amortization, treatment of intangibles acquired in business combinations etc. (2) Ind AS 38 recognizes that useful life of intangible assets can be indefinite, unlike the assumption of finite life under AS 26 (3) Ind AS 38 provides guidance on aspects like cessation of capitalization, de-recognition etc. which is not present in AS 26.

Overall, Ind AS 38