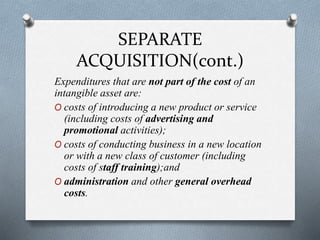

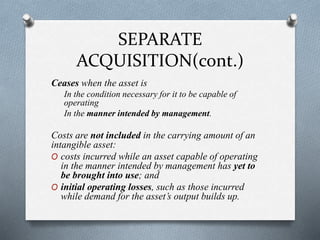

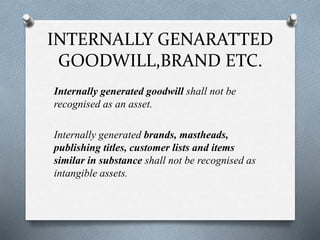

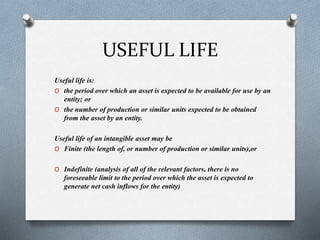

The document provides an overview of IAS 38 regarding intangible assets, defining them as identifiable non-monetary assets without physical substance. It outlines the criteria for recognition and measurement, including separable assets, internal goodwill limitations, useful life considerations, and how amortisation should be applied for finite and indefinite life assets. Additionally, it addresses disposals, derecognition of intangible assets, and the calculation of gains or losses from such derecognition.