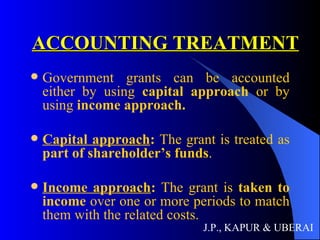

This document outlines accounting standards for government grants. It defines government grants and outlines how they should be accounted for, either through a capital or income approach. Grants should only be recognized when there is reasonable assurance of compliance with conditions and collection is certain. Extraordinary grants may be recognized immediately. Non-monetary grants are recorded at cost or nominal value. Grants related to assets may be deducted from assets, treated as deferred income, or credited to capital reserves. Grants related to revenue are recognized over related costs. Refunds of grants are also addressed.