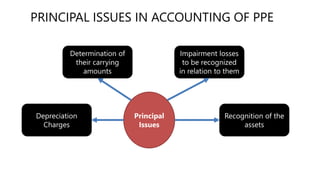

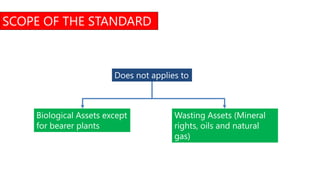

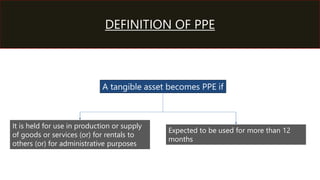

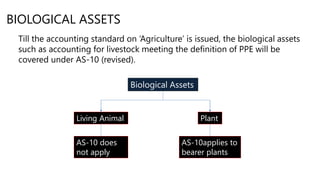

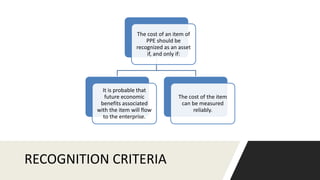

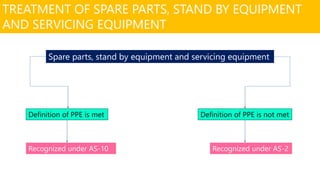

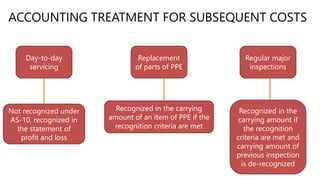

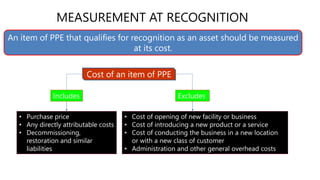

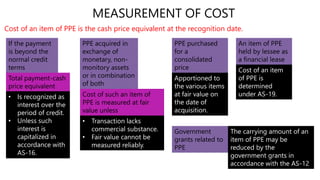

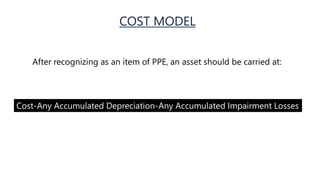

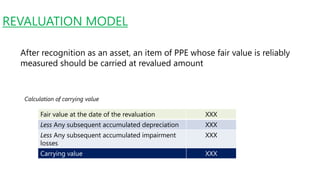

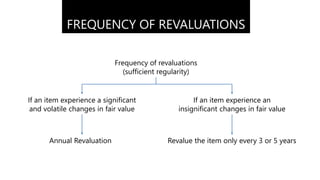

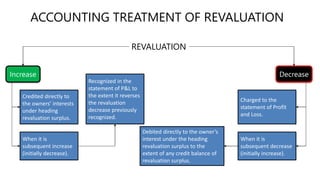

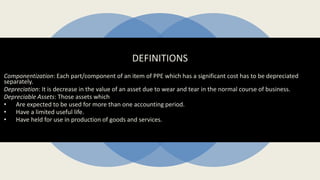

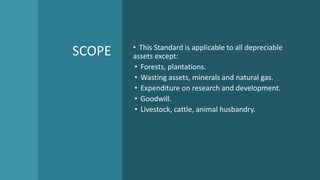

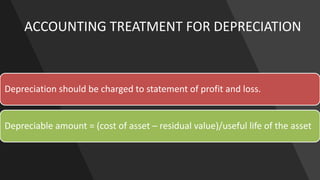

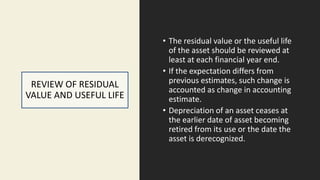

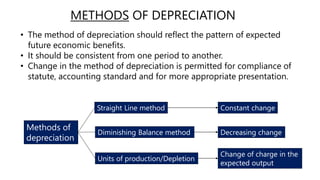

This document summarizes Accounting Standard 10 on Property, Plant and Equipment. It describes the objectives, scope, definitions and accounting treatment for PPE. Key points include: the standard establishes principles for recognition, measurement, presentation and disclosure of PPE; assets qualifying as PPE must be held for use in production or supply of goods/services and have a useful life of more than one year; PPE is initially measured at cost and subsequently using either the cost or revaluation model; depreciation is charged over the useful life of an asset using methods like straight line or diminishing balance; and gains or losses on disposal of PPE are included in profit or loss.