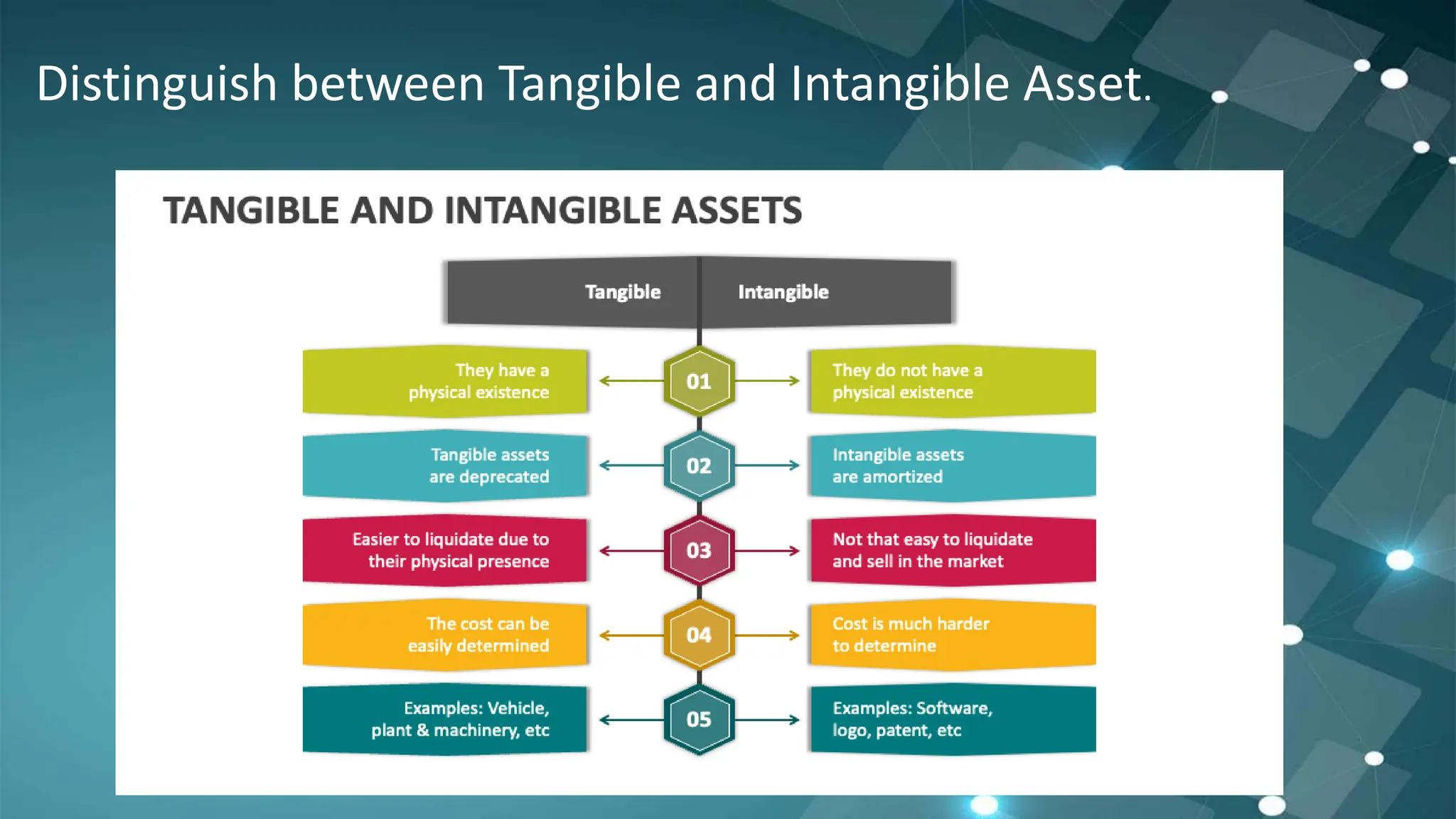

This document summarizes Accounting Standard 26 regarding intangible assets. It defines intangible assets as non-physical assets that provide future economic benefits and are controlled by an entity. Examples include goodwill, patents, trademarks, and software. Intangible assets must be recognized initially at cost and amortized over their useful lives, generally using the straight-line method over 10 years. When intangible assets are impaired, an impairment loss is recognized to reduce the carrying amount. The document also distinguishes research and development phases for self-generated intangible assets and outlines accounting for disposals of intangible assets.

![Recognition Of Intangible Assets

[1] Purchased INTANGIBLE ASSET should

be recorded at:

Cost Price Paid

ADD: Taxes Paid

ADD: Expenses To Obtain Title](https://image.slidesharecdn.com/pptas26-240107154550-869fa3e3/75/PPT-AS-26-pptx-powerpoint-presentation-adv-acc-6-2048.jpg)

![[2] Exchanged INTANGIBLE ASSET

Should be Recorded at

Fair Value Of Asset Surrendered

Whichever is more clearly evident

Fair Value Of Asset Obtained](https://image.slidesharecdn.com/pptas26-240107154550-869fa3e3/75/PPT-AS-26-pptx-powerpoint-presentation-adv-acc-7-2048.jpg)

![[3] Self Generated INTANGIBLE ASSETS are

those assets which are generated by the

entity at it own

Goodwill , Brand , Trade marks , Copyrights , should

be recorded as INTANGIBLE ASSET.

Remaining INTANGIBLE ASSETS Software ,

Website , Trademark , Knowhow are recorded as

follows:

Expenditure during RESEARCH PHASE will

be transferred to P&L A/C

Expenditure during DEVELOPMENT PHASE

will be capitalized with value of asset](https://image.slidesharecdn.com/pptas26-240107154550-869fa3e3/75/PPT-AS-26-pptx-powerpoint-presentation-adv-acc-8-2048.jpg)