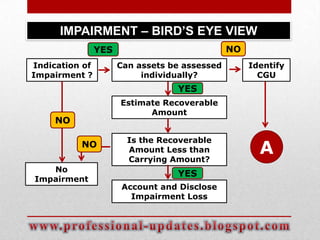

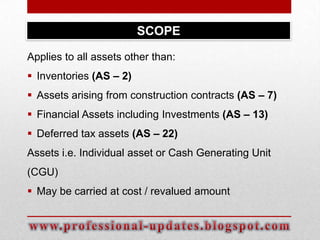

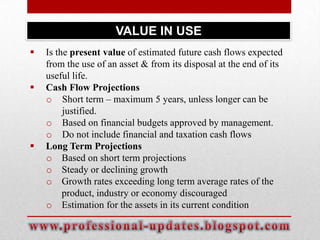

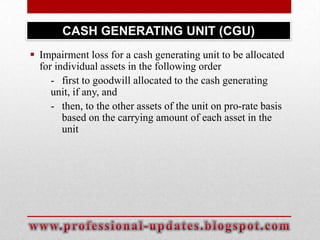

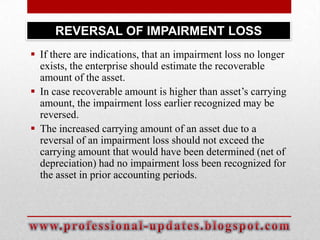

This document provides an overview of Accounting Standard 28 regarding impairment of assets. It outlines the objective to ensure assets are carried at no more than their recoverable amount. The standard is applicable to companies listed or in the process of listing with a turnover over 50 crores from 2004, and all other enterprises from 2005. Assets should be tested for impairment if there are any internal or external indicators, such as obsolescence, declines in value or performance. The recoverable amount is the higher of an asset's net selling price or value in use, which is the present value of estimated future cash flows. Impairment losses must be accounted for when the recoverable amount is less than the carrying amount.