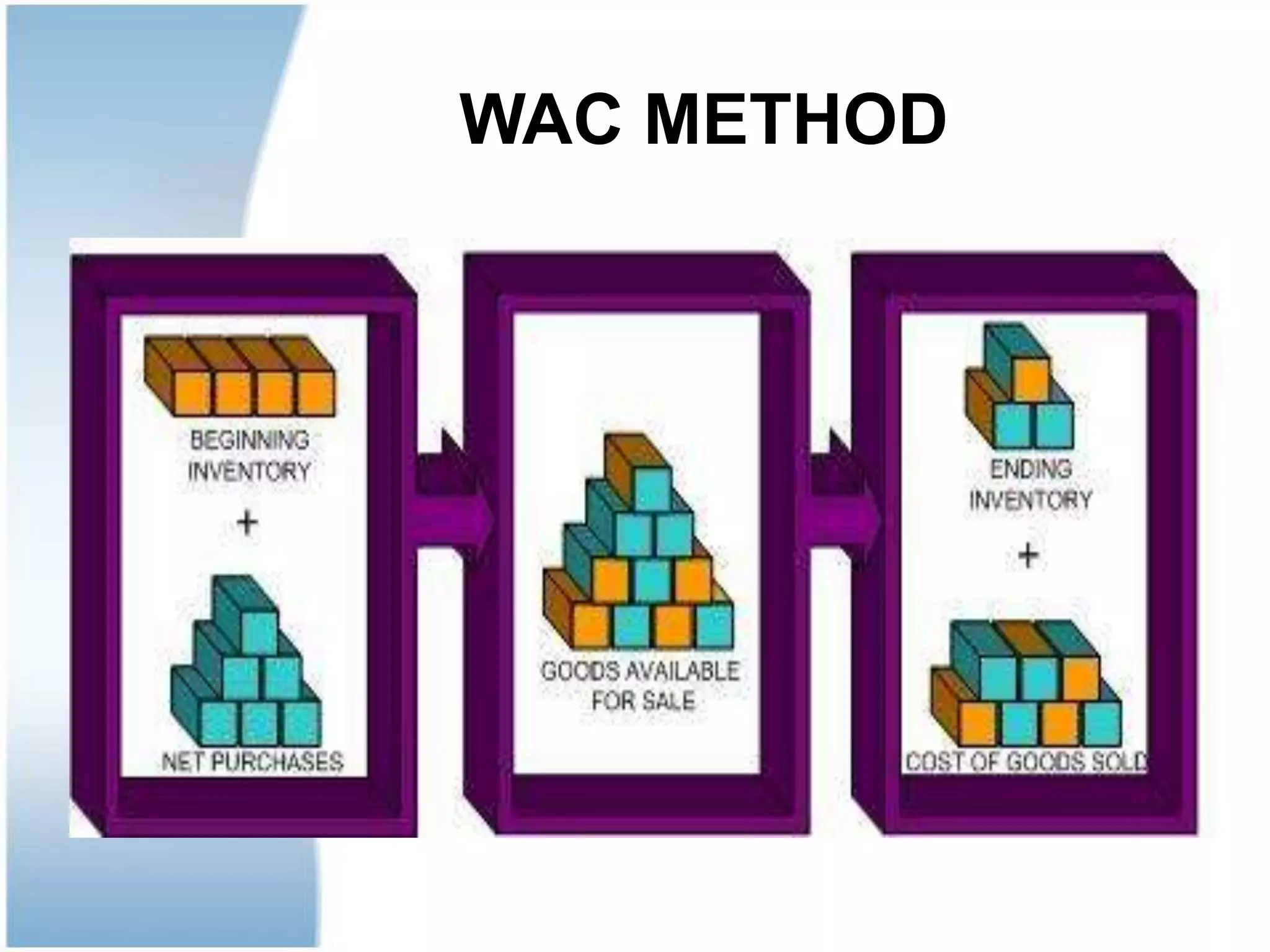

This document outlines accounting standards for valuing inventories. It defines inventories as assets held for sale, in production, or as materials used in production. Inventories should be valued at the lower of cost or net realizable value. Cost includes purchase price, conversion costs, and other costs to bring inventories to their present state. Net realizable value is estimated selling price less costs to complete and sell. Accepted cost flow methods for valuing inventories include FIFO, LIFO, and weighted average cost. Financial statements must disclose the accounting policy, cost formula used, and inventory classifications.