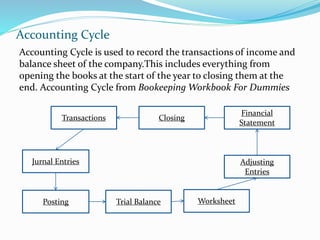

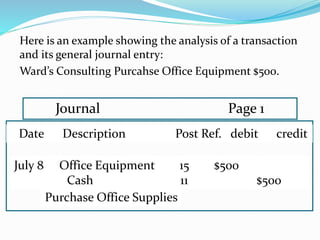

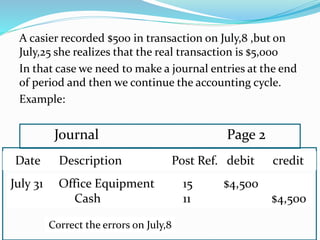

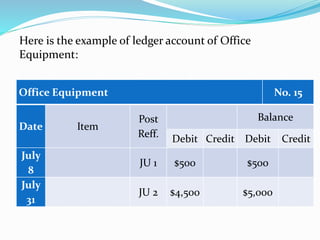

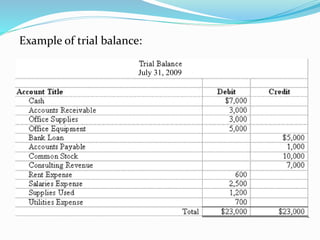

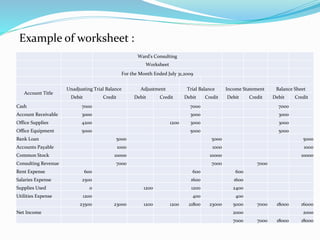

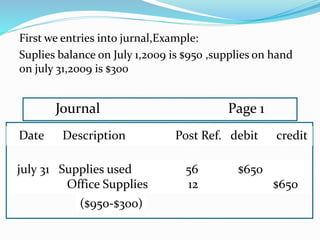

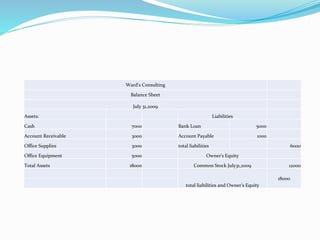

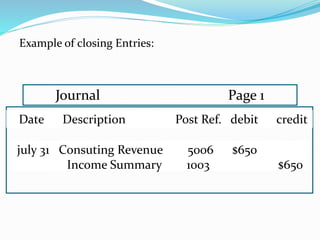

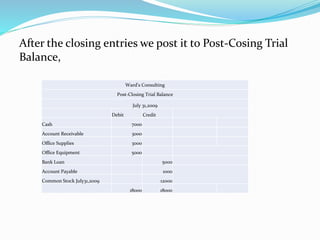

The accounting cycle is used to record business transactions throughout a period and ensure accurate financial reporting. It includes recording transactions, journal entries, posting to ledger accounts, preparing a trial balance, making adjustments, preparing a post-closing trial balance, and issuing financial statements. Errors can be corrected through adjusting journal entries made before closing entries transfer temporary account balances to prepare for the next accounting period.