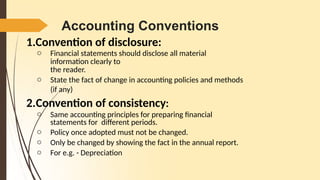

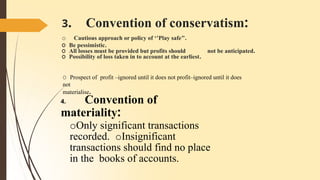

The document outlines the principles and concepts of accounting, including GAAP (Generally Accepted Accounting Principles) which ensure uniformity in financial reporting. Key concepts such as the business entity concept, going concern, and dual aspect are discussed along with various accounting conventions guiding the recording of financial transactions. The accounting equation is also introduced, emphasizing the equality between liabilities and assets.