Accounting principles provide guidelines for sound accounting practices and procedures. They aim to ensure uniformity and easy understanding of financial information.

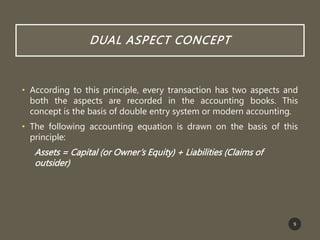

There are two main categories of accounting principles: concepts and conventions. Concepts are basic assumptions used as a foundation for recording transactions, while conventions are customs that guide financial statement preparation.

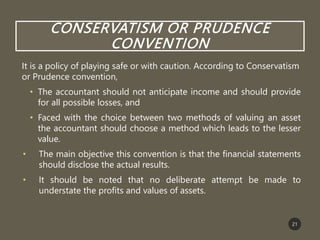

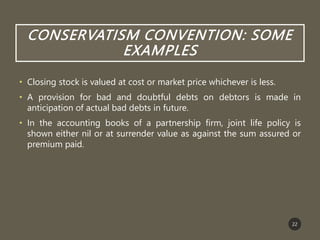

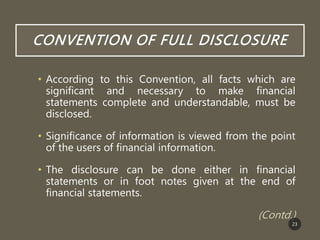

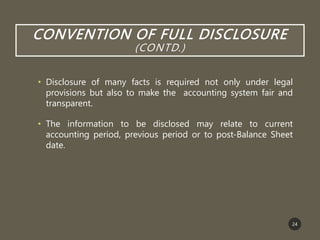

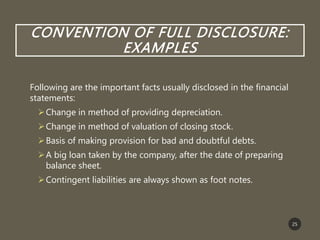

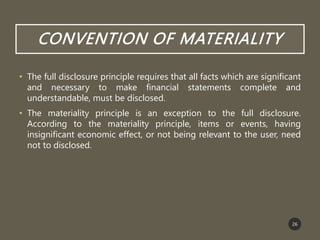

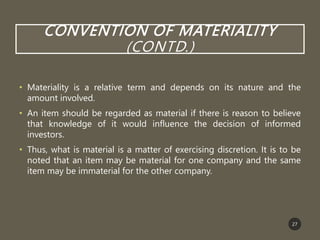

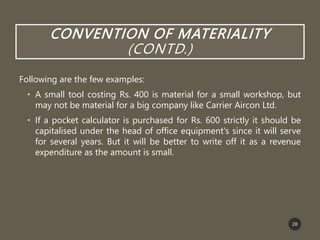

Key concepts include business entity, money measurement, cost, going concern, dual aspect, realization, accrual, accounting period, and matching. Important conventions are consistency, conservatism, full disclosure, and materiality. Consistency provides comparability over time, while conservatism plays it safe and avoids overstating values. Full disclosure and materiality aim to make financial statements complete and understandable.