1) The document discusses key accounting concepts and conventions. It defines 11 accounting concepts including business entity, money measurement, going concern, and historical cost.

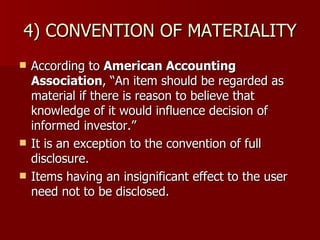

2) It also explains 3 common accounting conventions: full disclosure, consistency, and conservatism. Conventions represent generally accepted practices adopted through agreement, while concepts provide a theoretical foundation.

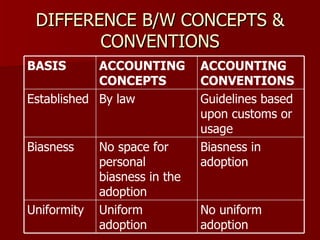

3) The main difference between concepts and conventions is that concepts cannot involve personal bias and are not uniformly adopted, while conventions are uniformly adopted based on customs or legal guidelines.