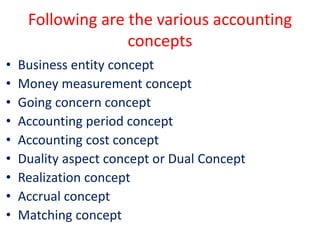

The document outlines essential accounting principles, including concepts and conventions that govern the preparation of financial statements. Key concepts such as the business entity concept, money measurement concept, and going concern concept are discussed, highlighting their significance in separating personal and business transactions, recording monetary transactions, and ensuring continuity of business operations. Additionally, accounting conventions like consistency, full disclosure, materiality, and conservatism are emphasized to guide accountants in presenting accurate and relevant financial information.