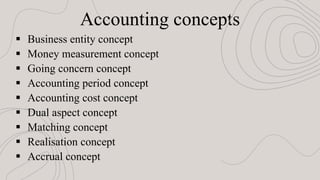

The document outlines key accounting concepts such as business entity, money measurement, going concern, and matching concepts, which serve as foundational assumptions for preparing financial statements. It emphasizes the importance of these concepts in differentiating personal and business transactions, recognizing revenue, and ensuring consistency and conservatism in financial reporting. Additionally, it discusses accounting conventions like consistency, materiality, and conservatism that guide accountants in presenting relevant financial information.