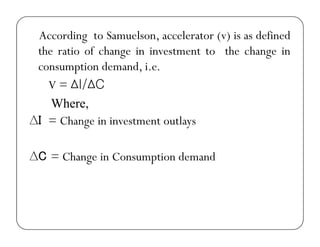

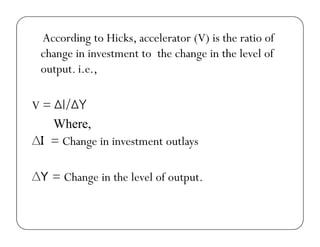

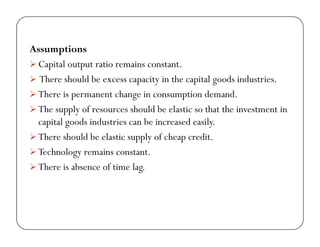

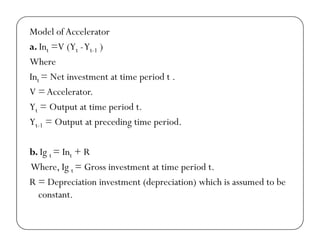

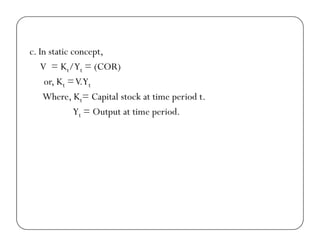

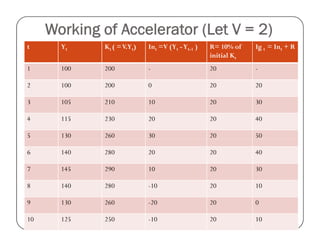

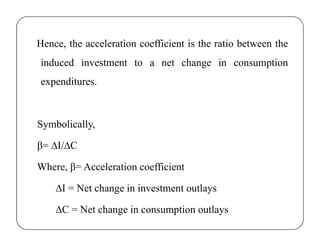

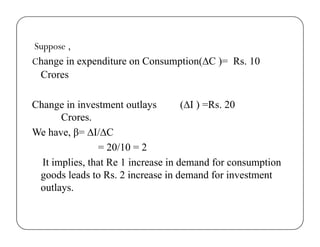

The accelerator theory states that an increase in demand for consumer goods will lead to an increase in demand for capital goods used to produce those consumer goods. It explains the relationship between consumer goods industries and capital goods industries. The accelerator coefficient is the ratio of change in investment to change in consumption or output. The accelerator theory was introduced by T.N. Carver in 1903 and further developed by economists like Harrod, Solow, Samuelson and Hicks to explain business cycles. It assumes a constant capital-output ratio and elastic supply of credit and resources so investment can adjust to changes in demand.