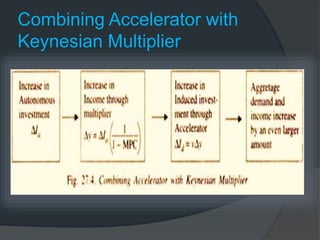

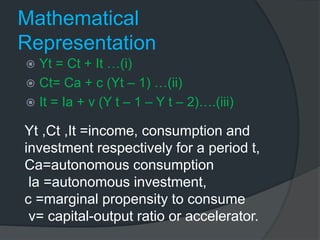

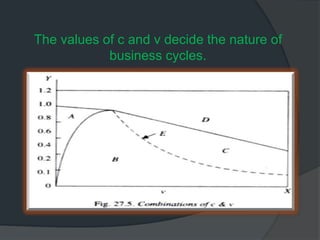

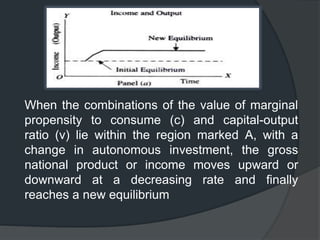

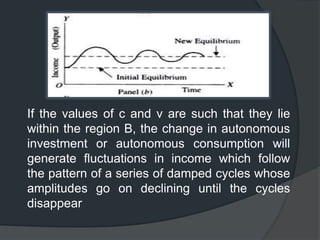

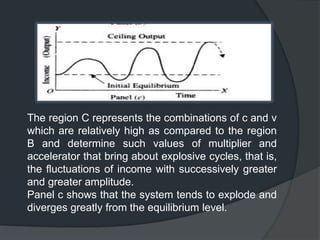

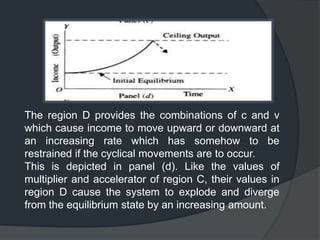

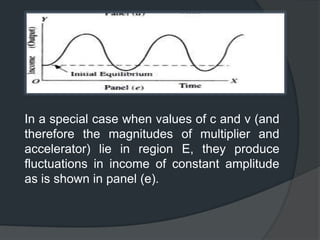

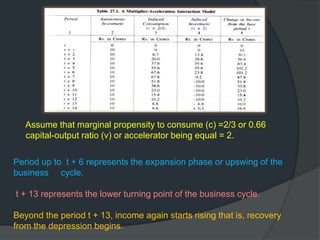

The document summarizes Samuelson's model of business cycles, which relates economic fluctuations to the interaction between the multiplier and accelerator effects. It explains that the multiplier amplifies changes in autonomous investment and consumption, while the accelerator reinforces increases in income through further induced investment. The model is represented mathematically to show how different combinations of the multiplier and accelerator can produce equilibrium, damped cycles, explosive cycles, or cycles of constant amplitude to describe business cycle patterns.