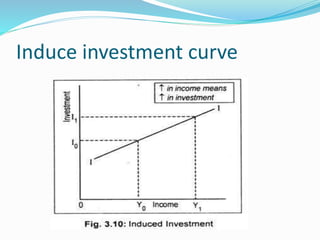

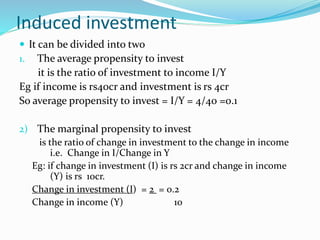

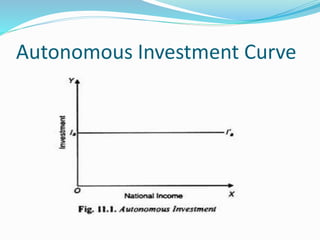

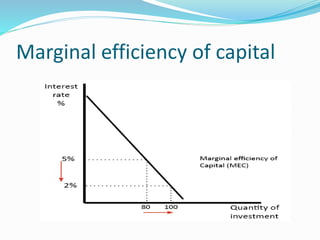

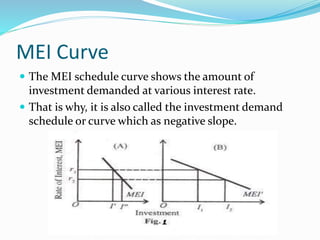

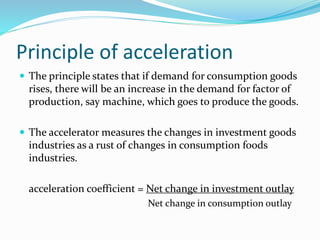

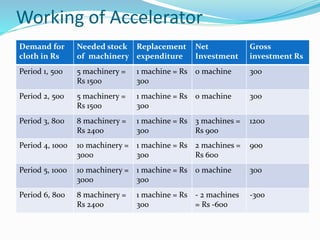

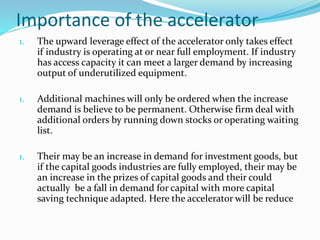

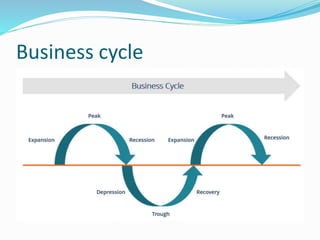

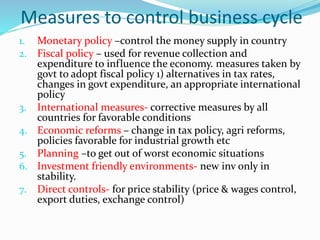

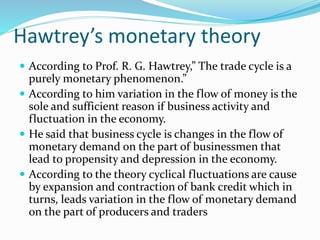

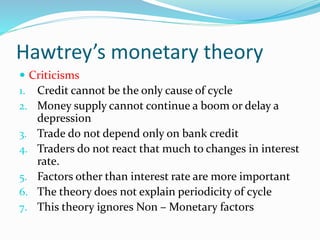

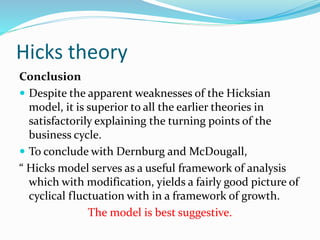

This document summarizes key concepts related to consumption functions, investment functions, and business cycles. It defines consumption and investment functions, explaining factors like disposable income, autonomous consumption, and marginal propensity to consume in consumption functions. It also discusses induced and autonomous investment, the marginal efficiency of capital, and determinants of investment levels. The document then explains concepts like the multiplier, accelerator, phases of the business cycle, and theories of the business cycle like monetary, innovation, and Keynesian theories.