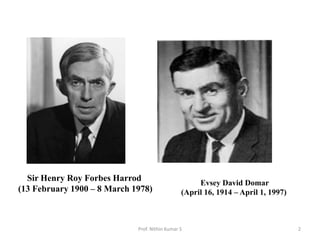

The document discusses the Harrod-Domar model of economic growth developed by Roy Harrod and Evsey Domar. Some key points:

1. The model focuses on the role of capital accumulation and investment in driving economic growth.

2. It uses the capital-output ratio and investment ratio to determine the rate of economic growth.

3. Harrod identified the actual, warranted, and natural rates of growth and argued stability requires equality between these rates.

4. The warranted rate depends on capital-output ratio and savings ratio matching the demand and supply of capital.

5. The natural rate is determined by long-term factors like population and technology.

![• GC=S

• Where,

• G= Actual rate of growth

• C= Capital-output ratio [

𝜟𝑲

𝜟𝒀

]

• S= Savings-income ratio [

𝑺

𝒀

]

Prof. Nithin Kumar S 17](https://image.slidesharecdn.com/harroddomarmodel-240117051306-c1f98de7/85/Harrod-Domar-Model-Development-Model-pptx-17-320.jpg)