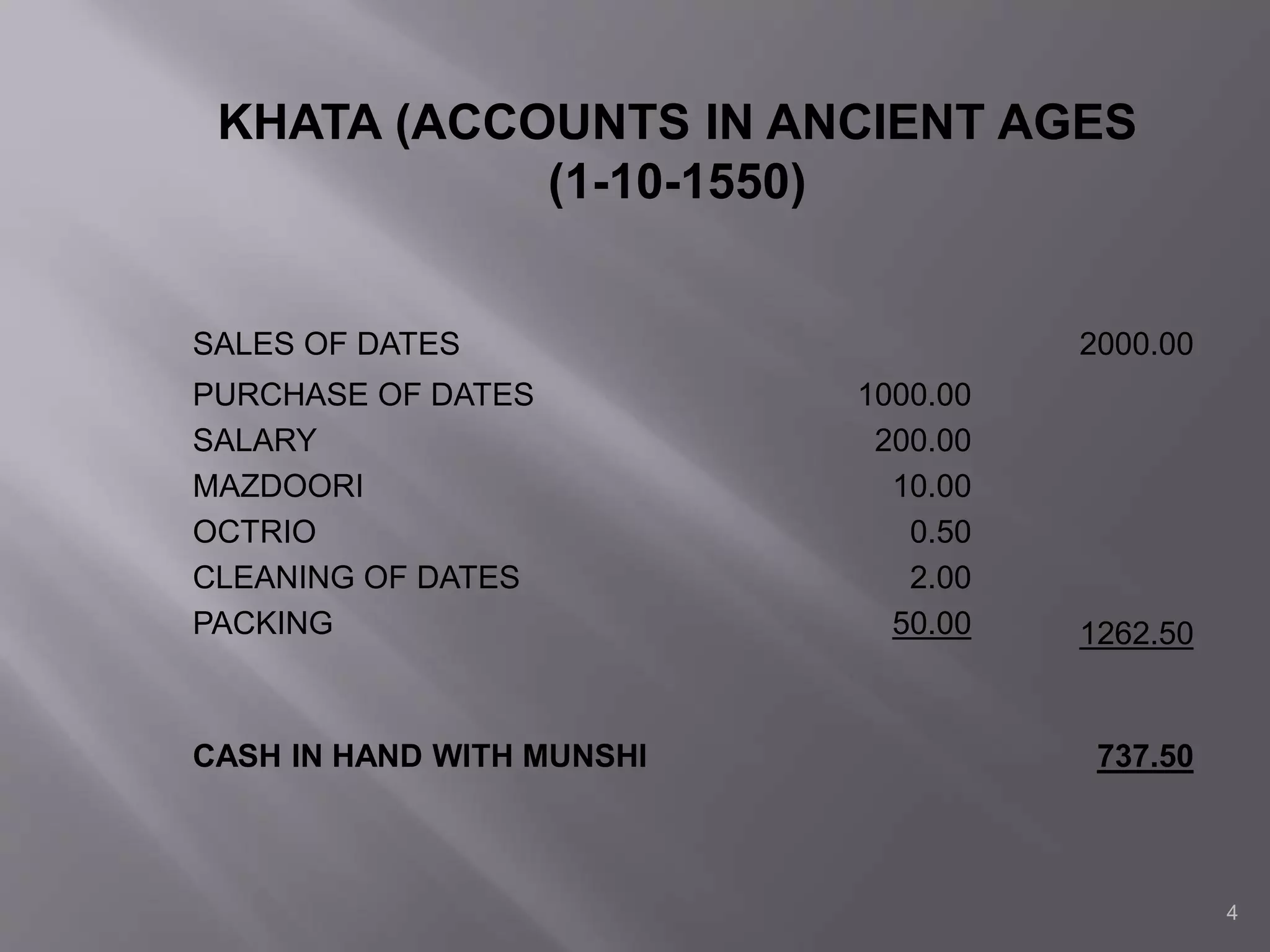

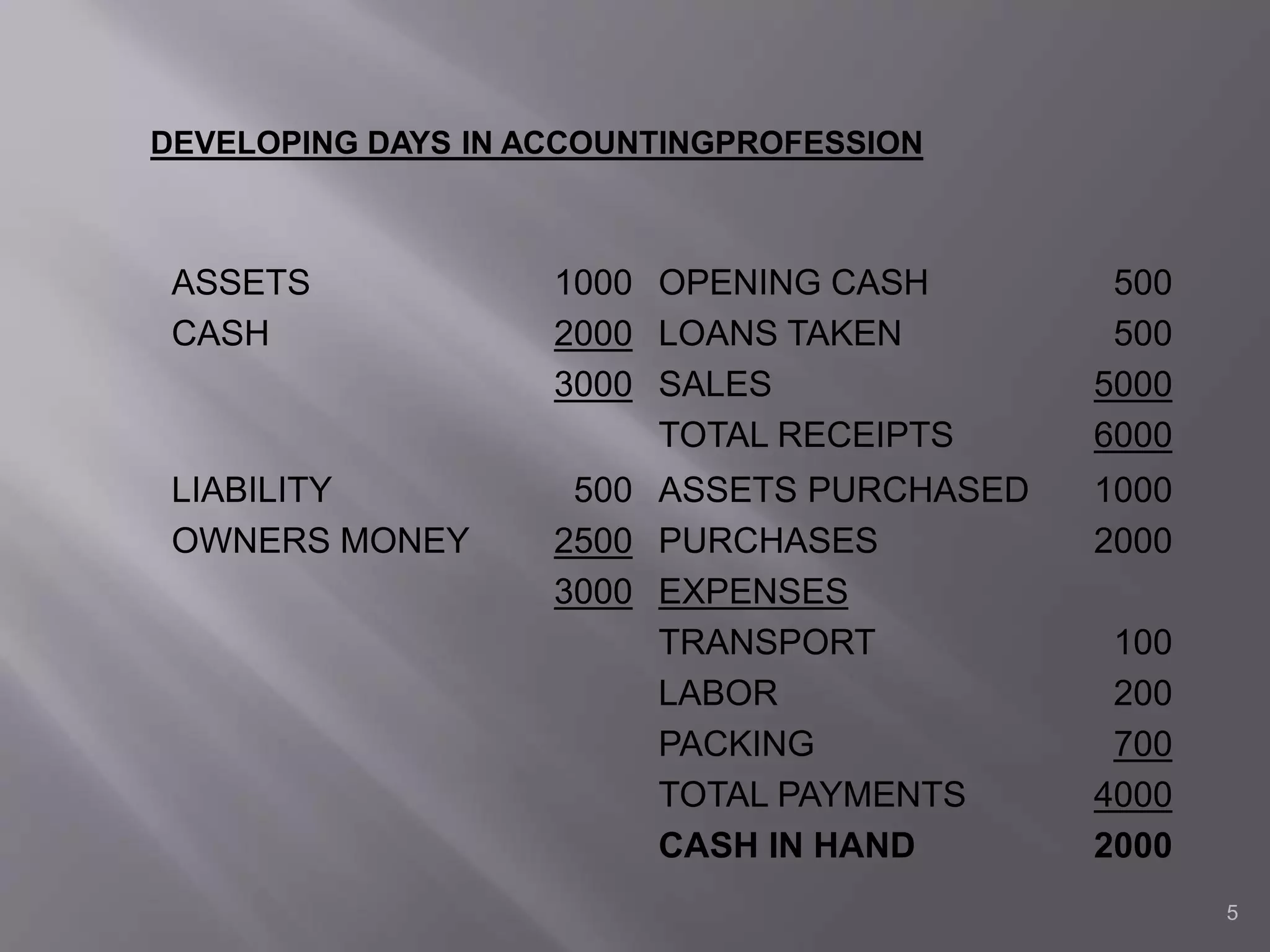

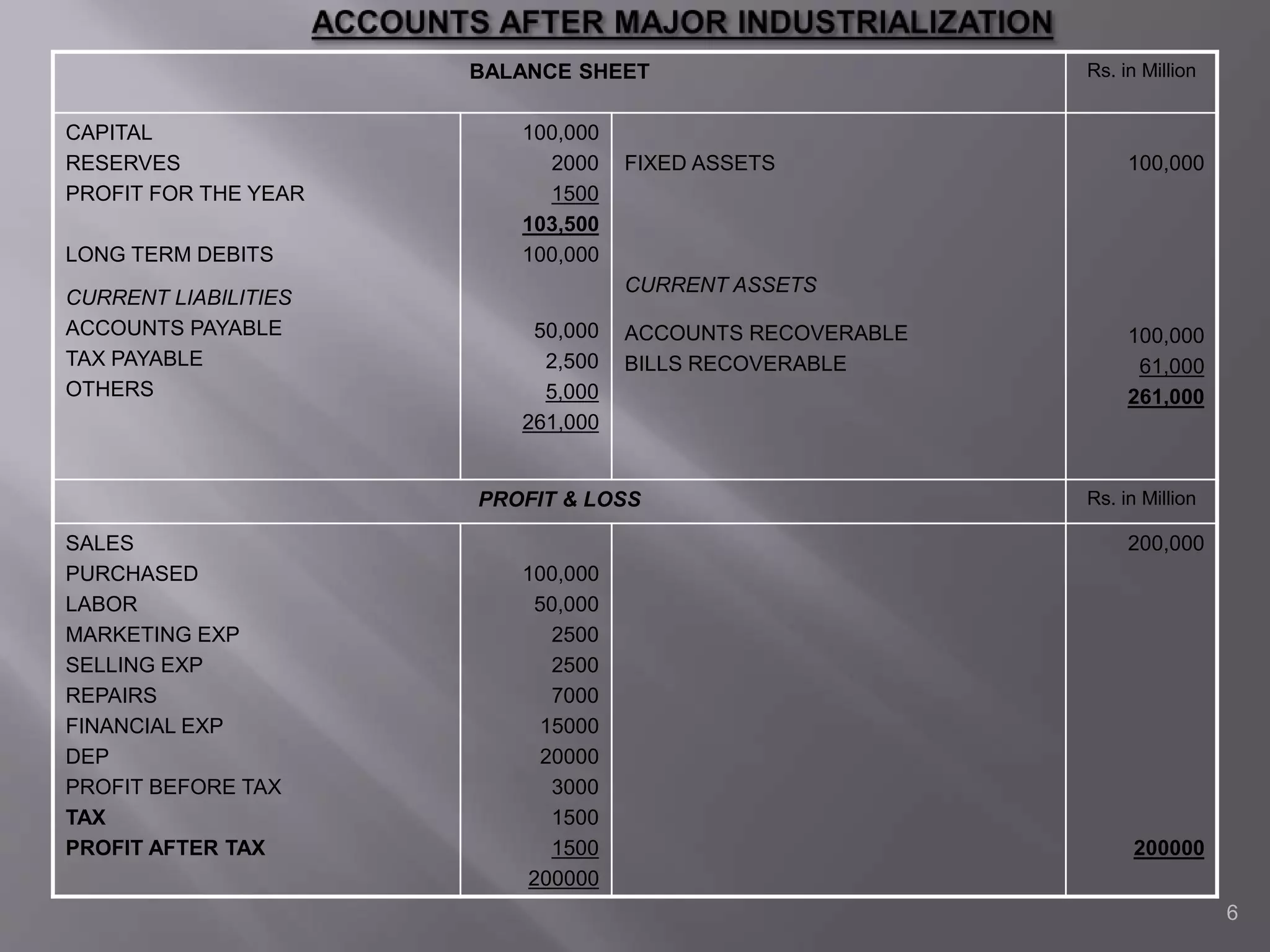

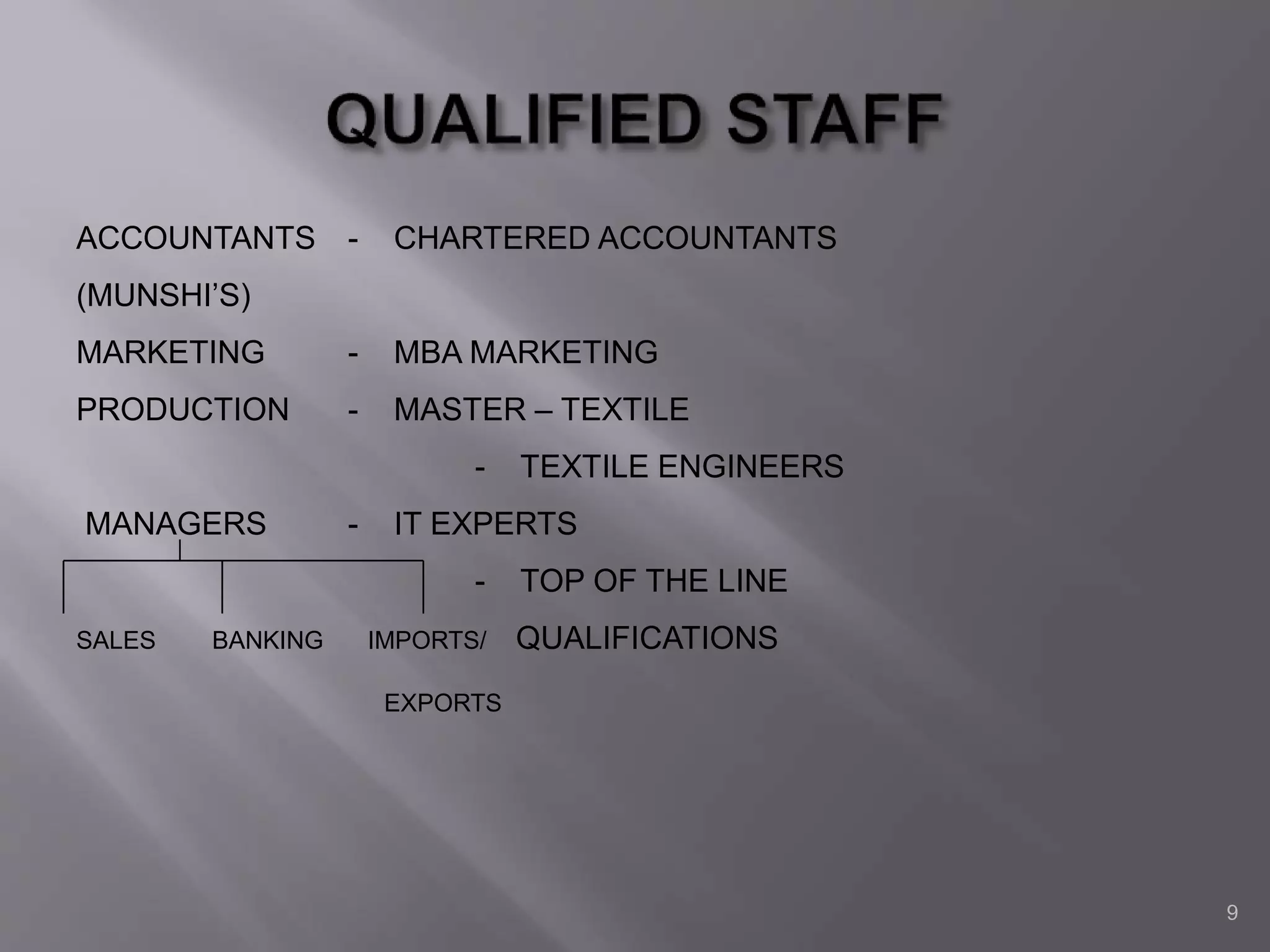

The document discusses the evolution of the auditor role from a historical account checker to a modern business advisor. Initially, auditors were assumed to be trustworthy but lacked formal qualifications. Over time, business grew more complex with technology, globalization, and competition requiring auditors to have specialized expertise in areas like finance, industry knowledge, economics, and technology. Modern auditors help identify risks, opportunities, and create effective control environments for businesses. The role expanded from verification of historical accounts to providing strategic advice and ensuring financial discipline.