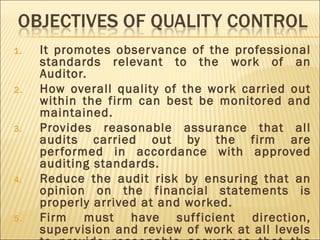

1. The document discusses quality control procedures that an audit firm should implement to ensure high quality audits and audit reports.

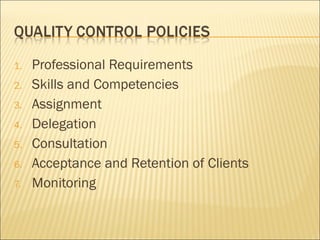

2. It describes key aspects of quality control including delegation, direction, supervision, review, skills and competencies of staff, client acceptance policies, and monitoring procedures.

3. The purpose is to provide reasonable assurance that audits are performed according to standards and that audit opinions are properly supported.