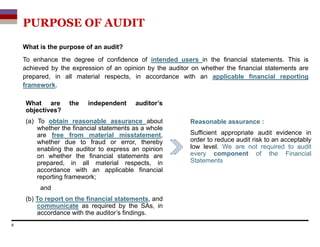

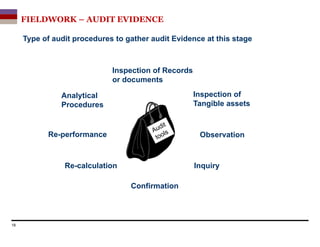

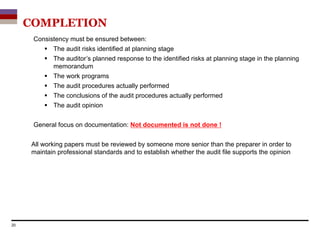

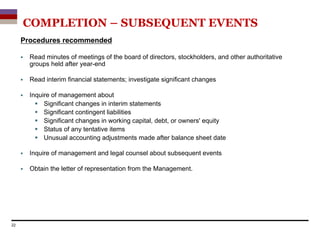

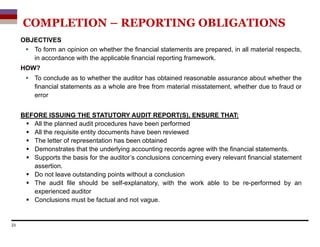

The document discusses key aspects of statutory audits, including audit documentation, planning, fieldwork, completion, and reporting obligations. It covers topics such as the purpose of audit documentation, planning considerations, types of audit evidence, subsequent event procedures, and objectives of audit reporting. Key requirements around documentation standards, tailoring the audit, and ensuring work is reviewed are also summarized.