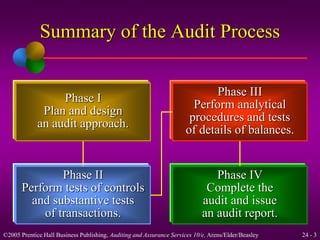

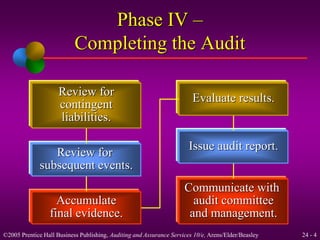

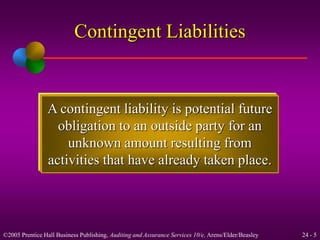

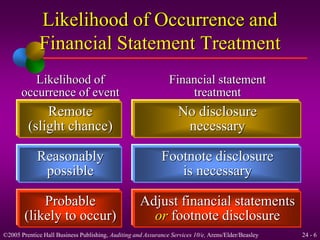

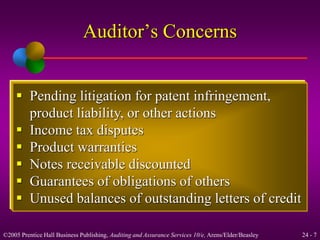

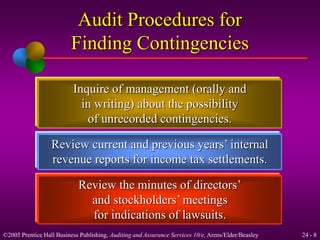

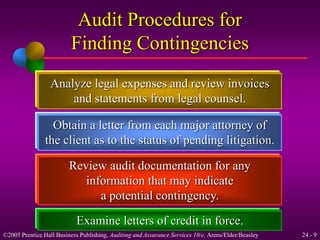

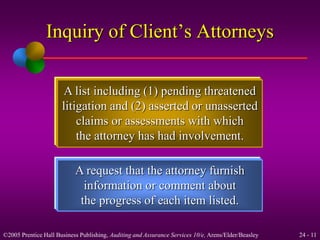

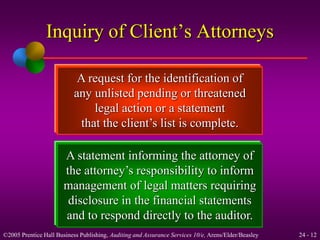

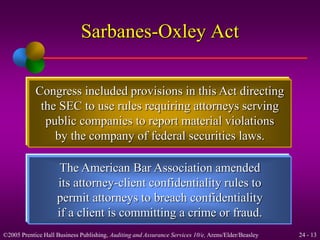

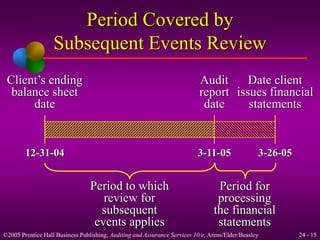

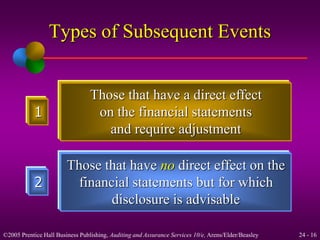

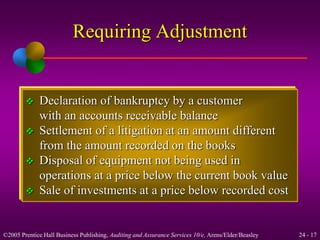

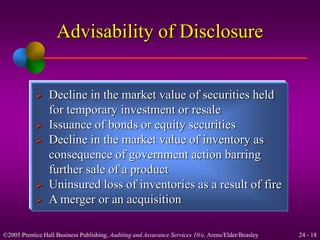

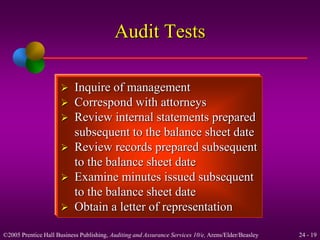

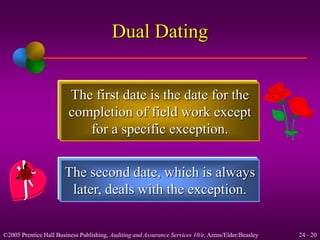

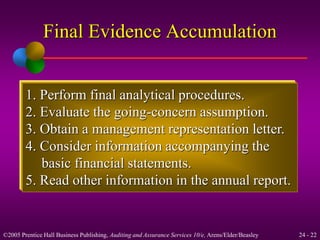

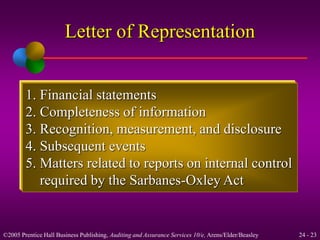

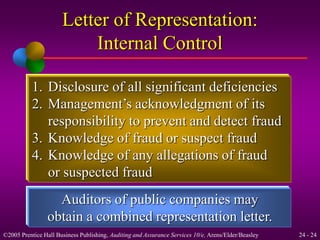

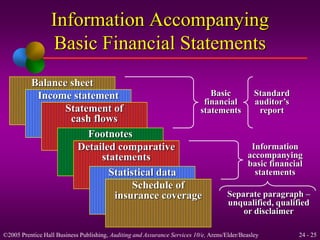

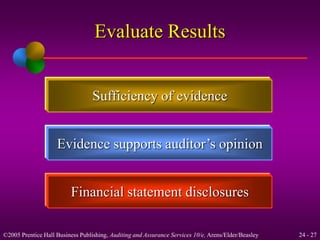

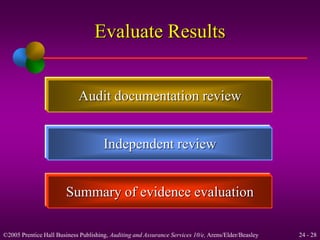

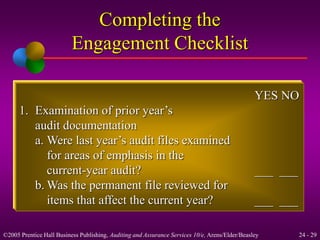

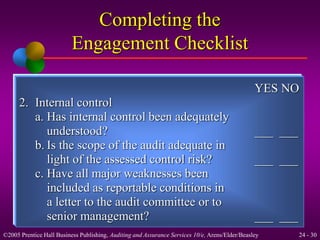

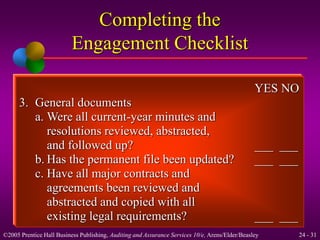

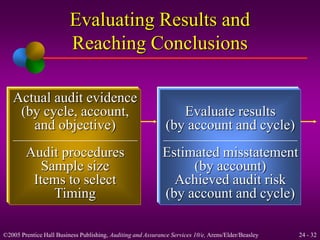

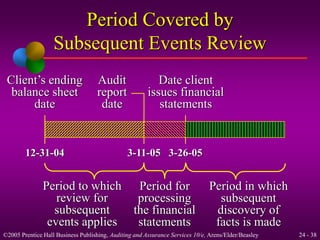

The document discusses completing the audit process. It covers reviewing for contingent liabilities and commitments, obtaining and evaluating letters from the client's attorneys, conducting a post-balance sheet review for subsequent events, accumulating final evidence including analytical procedures and representation letters, evaluating overall audit results, communicating with the audit committee and management, and addressing the discovery of new information after issuing the audit report.