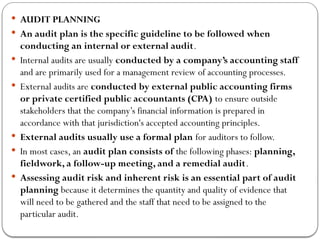

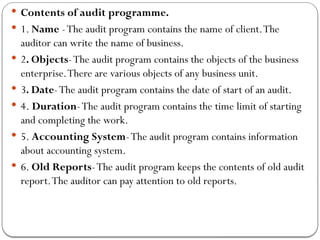

The document outlines the audit process, including planning, fieldwork, reporting, and follow-up, emphasizing the importance of audit programs, audit risk, and inherent risk. It covers various aspects of audit planning, types of audits, and the roles of auditors and their staff, along with the significance of documentation and audit working papers. Additionally, it highlights the types of audit reports and their implications regarding a company's financial statements.

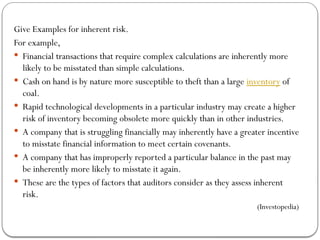

![ Audit risk (also referred to as residual risk) refers to the risk that

an auditor may issue an unqualified report due to the auditor's

failure to detect material misstatement either due to error or

fraud.This risk is composed of:

Inherent risk (IR), the risk involved in the nature of business or

transaction. Example, transactions involving exchange of cash may have

higher IR than transactions involving settlement by cheques.The

term inherent risk may have other definitions in other contexts.[1]

;

Control risk (CR), the risk that a misstatement may not be prevented

or detected and corrected due to weakness in the entity's

internal control mechanism. Example, control risk assessment may be

higher in an entity where separation of duties is not well defined; and

Detection risk (DR), the probability that the audit procedures may fail

to detect existence of a material error or fraud. Detection risk may be

due to sampling error or non-sampling error.[2]](https://image.slidesharecdn.com/auditngandcontrol1-chapter4-241005163637-16fa9fbc/85/Auditng-and-Control-1-Audit-and-work-Chapter-4-pptx-12-320.jpg)

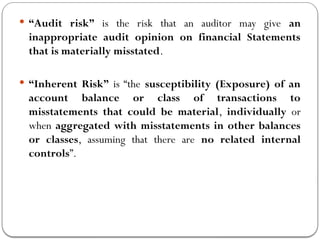

![ “Audit risk” is the risk that an auditor may give an i………

audit opinion on financial Statements that is materially

m……….

[There is a material misstatement but the auditor could

not identify and given an qualified opinion]

“Inherent Risk” is “the s………y (Exposure) of an

account balance or class of transactions to

misstatements that could be m………l, individually or

when aggregated with misstatements in other balances or classes,

assuming that there are no related internal controls”.

[There is a possibility of misstatement in a class of

transactions/balance of an account due to poor internal

control]](https://image.slidesharecdn.com/auditngandcontrol1-chapter4-241005163637-16fa9fbc/85/Auditng-and-Control-1-Audit-and-work-Chapter-4-pptx-13-320.jpg)

![ Supplementary Study Material

Audit risk (also referred to as residual risk) refers to the risk that an auditor may issue

an unqualified report due to the auditor's failure to detect material

misstatement either due to error or fraud.This risk is composed of:

Inherent risk (IR), the risk involved in the nature of business or transaction. Example,

transactions involving exchange of cash may have higher IR than transactions involving

settlement by cheques.The term inherent risk may have other definitions in other contexts.[1]

;

Control risk (CR), the risk that a misstatement may not be prevented or detected and

corrected due to weakness in the entity's internal control mechanism. Example, control risk

assessment may be higher in an entity where separation of duties is not well defined; and

Detection risk (DR), the probability that the audit procedures may fail to detect existence

of a material error or fraud. Detection risk may be due to sampling error or

non-sampling error.[2]](https://image.slidesharecdn.com/auditngandcontrol1-chapter4-241005163637-16fa9fbc/85/Auditng-and-Control-1-Audit-and-work-Chapter-4-pptx-37-320.jpg)