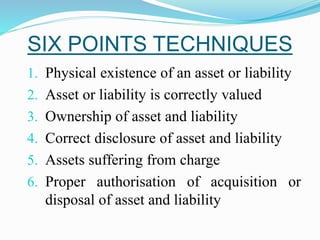

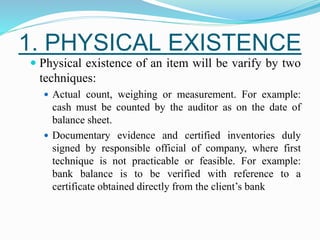

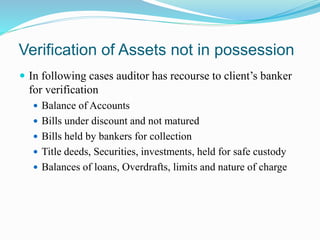

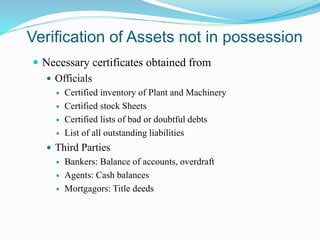

The document discusses techniques for verifying assets and liabilities during an audit. It outlines six key techniques: 1) verifying physical existence, 2) assessing correct valuation, 3) confirming ownership, 4) ensuring proper disclosure, 5) identifying any charges on assets, and 6) checking for proper authorization of transactions. Specific procedures are described for different asset types, including obtaining certificates from management and third parties. The auditor must also consider events after the balance sheet date and obtain a management representation letter.