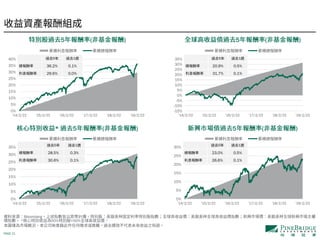

- The document appears to be a financial report containing market data and commentary from February 22, 2019. It includes statistics on bond yields, stock market indexes, commodities prices, and other economic indicators.

- On the first page it mentions the US Federal Reserve's Federal Open Market Committee meeting and current US Treasury yield rates.

- Subsequent pages provide performance data for various stock indexes, economic indicators from different countries, and commodity price changes.