This document contains market and economic indicators from various dates in October 2019. It includes:

- Stock market performance for various indices such as the S&P 500 and DAX on pages 2-3.

- Commodity price movements for items like oil and metals on page 4.

- Economic data from countries including ISM PMI reports and CPI inflation figures on pages 8-10.

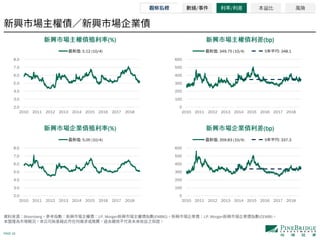

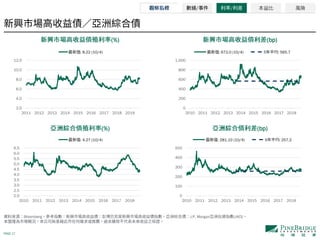

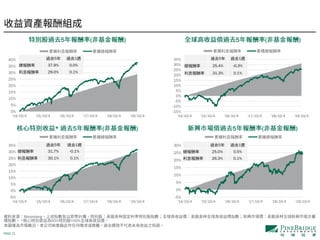

- Bond yield curves and risk premiums for different markets on pages 13-21.