The document appears to be a multi-page financial report from Bloomberg containing the following key information:

- Market performance data for various indexes such as the S&P 500 and Nikkei 225 for different dates. Percentage changes and closing values are provided.

- Economic indicators like PMI readings, unemployment claims, and GDP figures. Specific numbers for the US and other countries are mentioned.

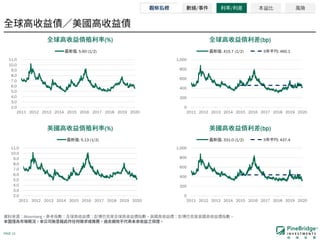

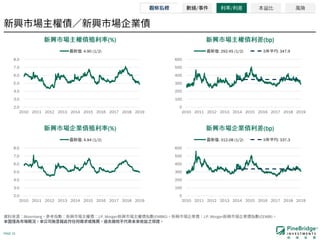

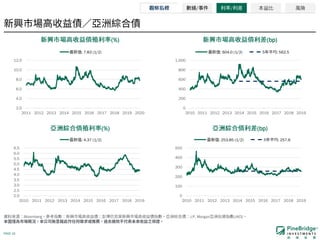

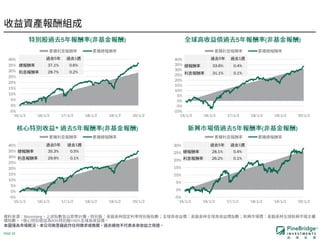

- Interest rate levels and bond yield curves. Graphs showing rates over time are included.

- Commodity prices for oil, metals, and agricultural goods. Specific percentages regarding price changes are listed.

- Currencies exchange rates and trade balance numbers for different nations. Specific currency pairs and dollar values