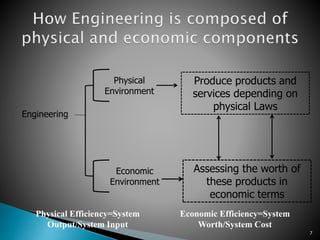

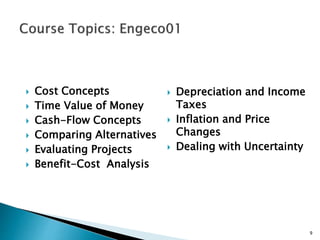

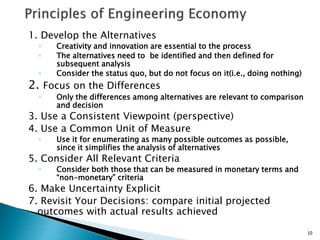

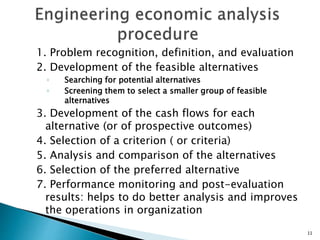

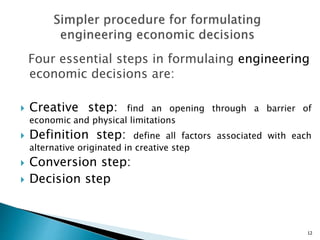

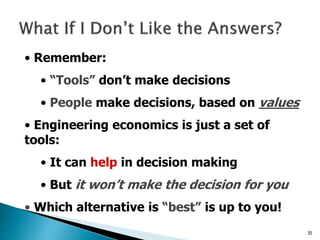

This document provides an introduction to the concepts of engineering economics and engineering. It defines engineering economics as the application of economic principles to the evaluation of design and engineering alternatives. Some key points covered include:

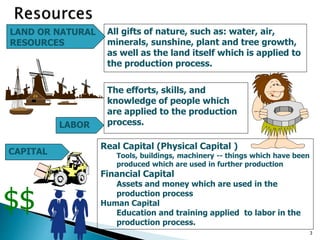

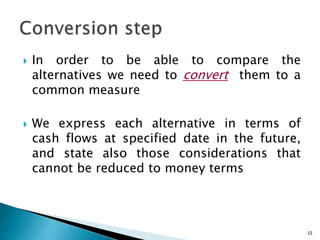

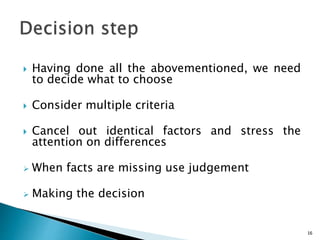

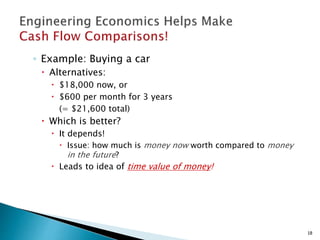

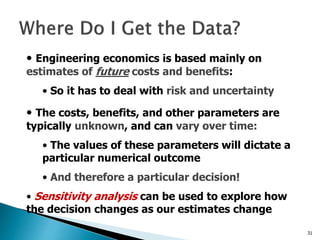

- Engineering economics involves formulating, estimating, and evaluating economic outcomes of alternatives using mathematical relationships to compare cash flows. It must deal with risk and uncertainty.

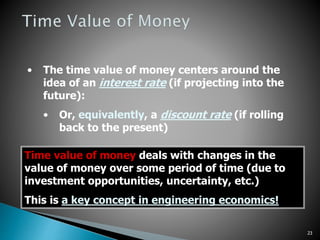

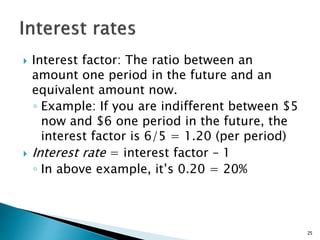

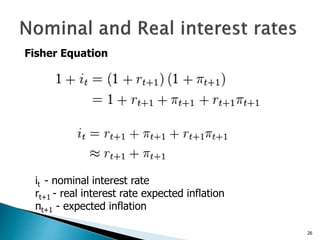

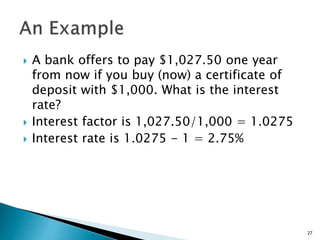

- The time value of money is a central concept, dealing with how the value of money changes over time due to factors like investment opportunities and inflation. Interest rates and discount rates are used to relate amounts over different time periods.

- Engineering economics helps engineers make good decisions by assessing alternatives in economic terms and identifying the most efficient solution based on costs, benefits