This document discusses replacement studies and key concepts:

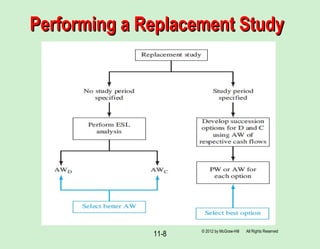

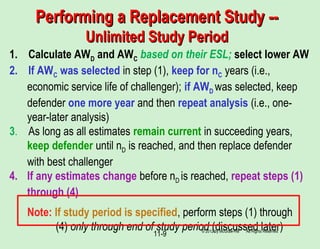

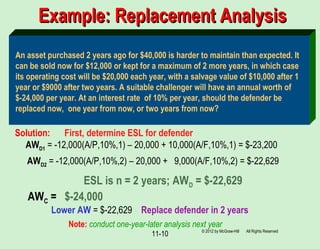

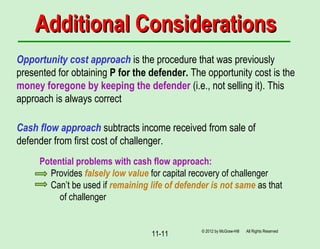

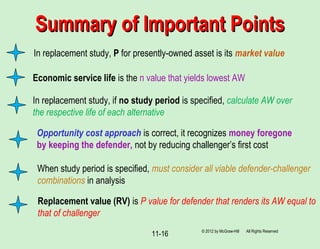

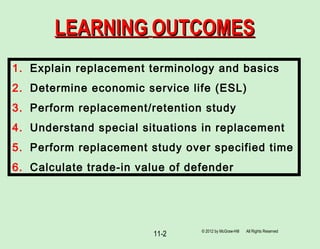

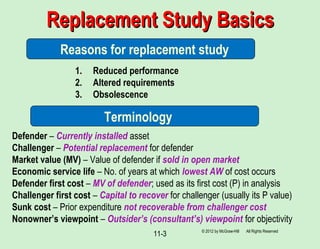

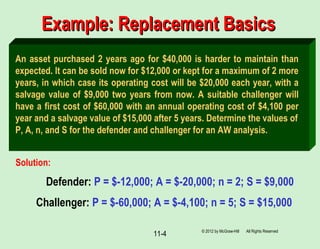

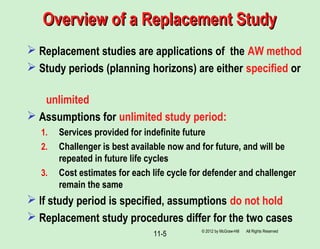

1. A replacement study determines whether to replace an existing asset (defender) or keep it by comparing the annual worth (AW) of the defender to potential replacement assets (challengers).

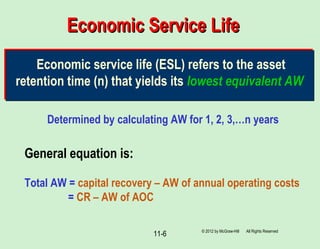

2. The economic service life is the number of years an asset can be kept until its AW is lowest.

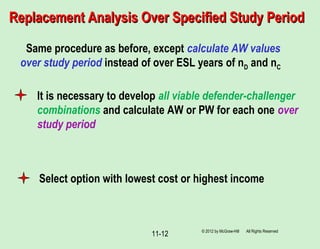

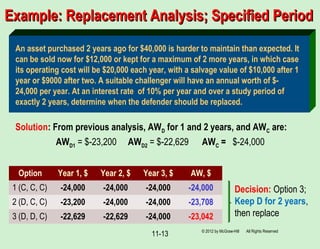

3. A replacement study either considers an unlimited time horizon or a specified study period. Over unlimited time, the defender is kept until its economic service life and then replaced. Within a specified period, all combinations are considered.

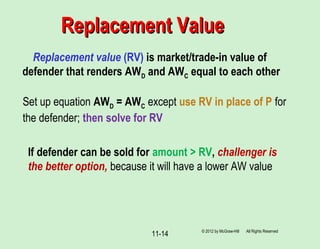

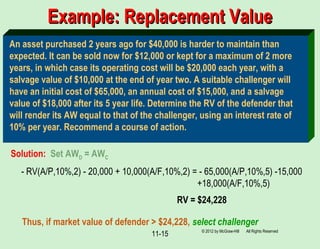

4. The replacement value is the defender's market value that equalizes its AW with a challenger, helping determine if the challenger

+ 8000(A/F,10%,2)

= $ -13,429

Similarly, AW3 = $ -13,239 AW4 = $ -12,864 AW5 = $ -13,623

Economic service life is 4 years

Solution:

© 2012 by McGraw-Hill All Rights Reserved](https://image.slidesharecdn.com/chapter11-replacementretentiondecisions-140315184111-phpapp02/85/Chapter-11-replacement-retention-decisions-7-320.jpg)