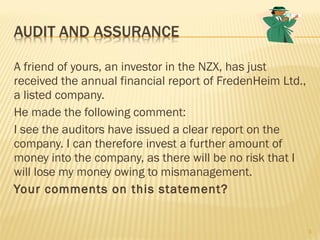

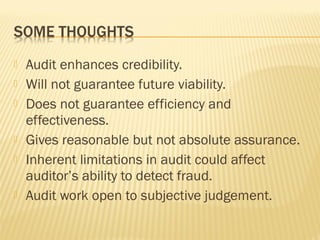

This document discusses the role and responsibilities of auditors. It begins by asking introductory questions about how the audit role is understood, whether there are conflicts in market perceptions of accountant services, what an audit is, and what an auditor's role entails. It then discusses a scenario where an investor believes an auditor's clear report means there is no risk of losing money in a company. The document provides comments on this statement and outlines key aspects of auditing like enhancing credibility but not guaranteeing future viability or guaranteeing efficiency. It also lists some common misconceptions about auditor responsibilities.