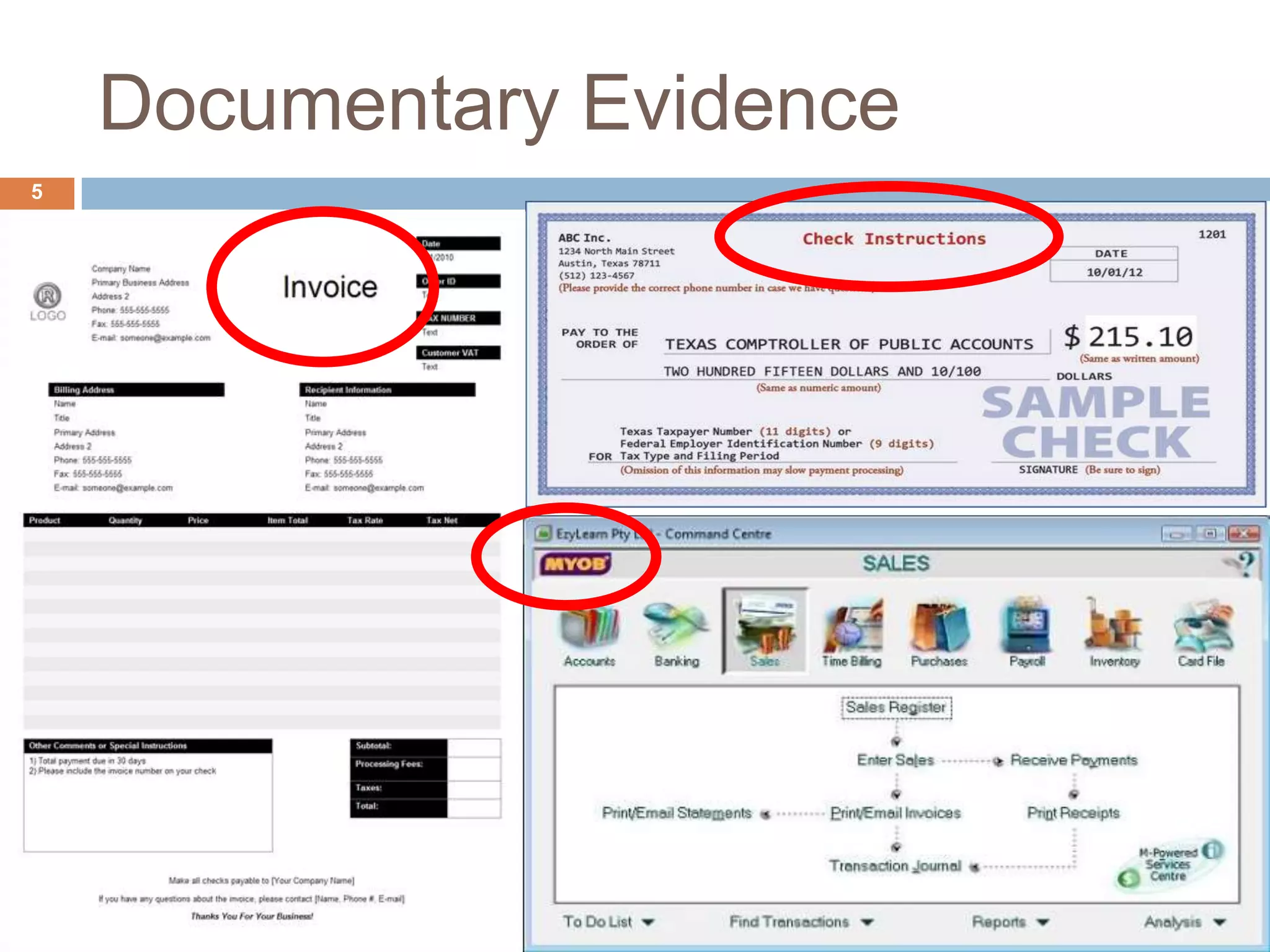

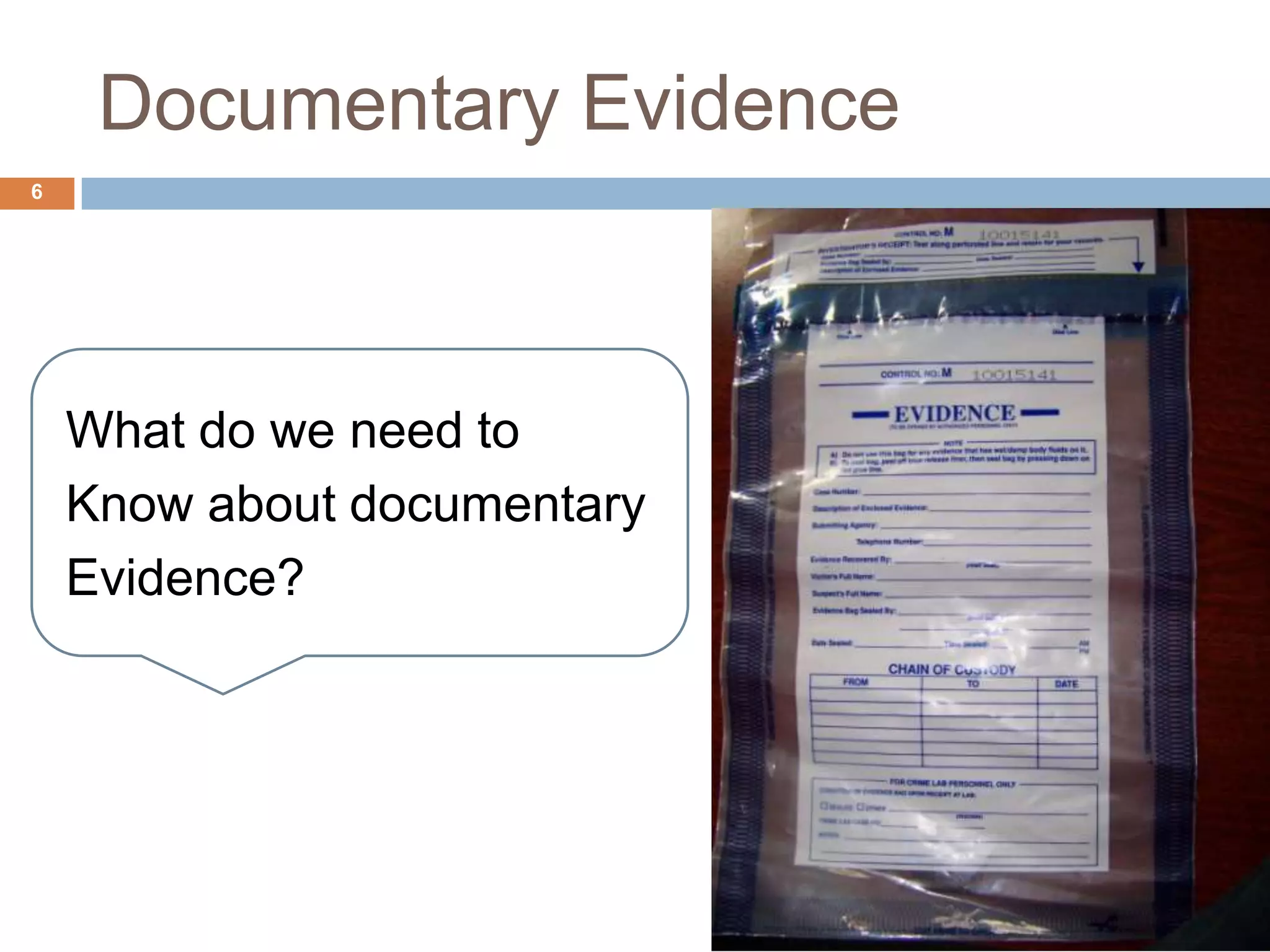

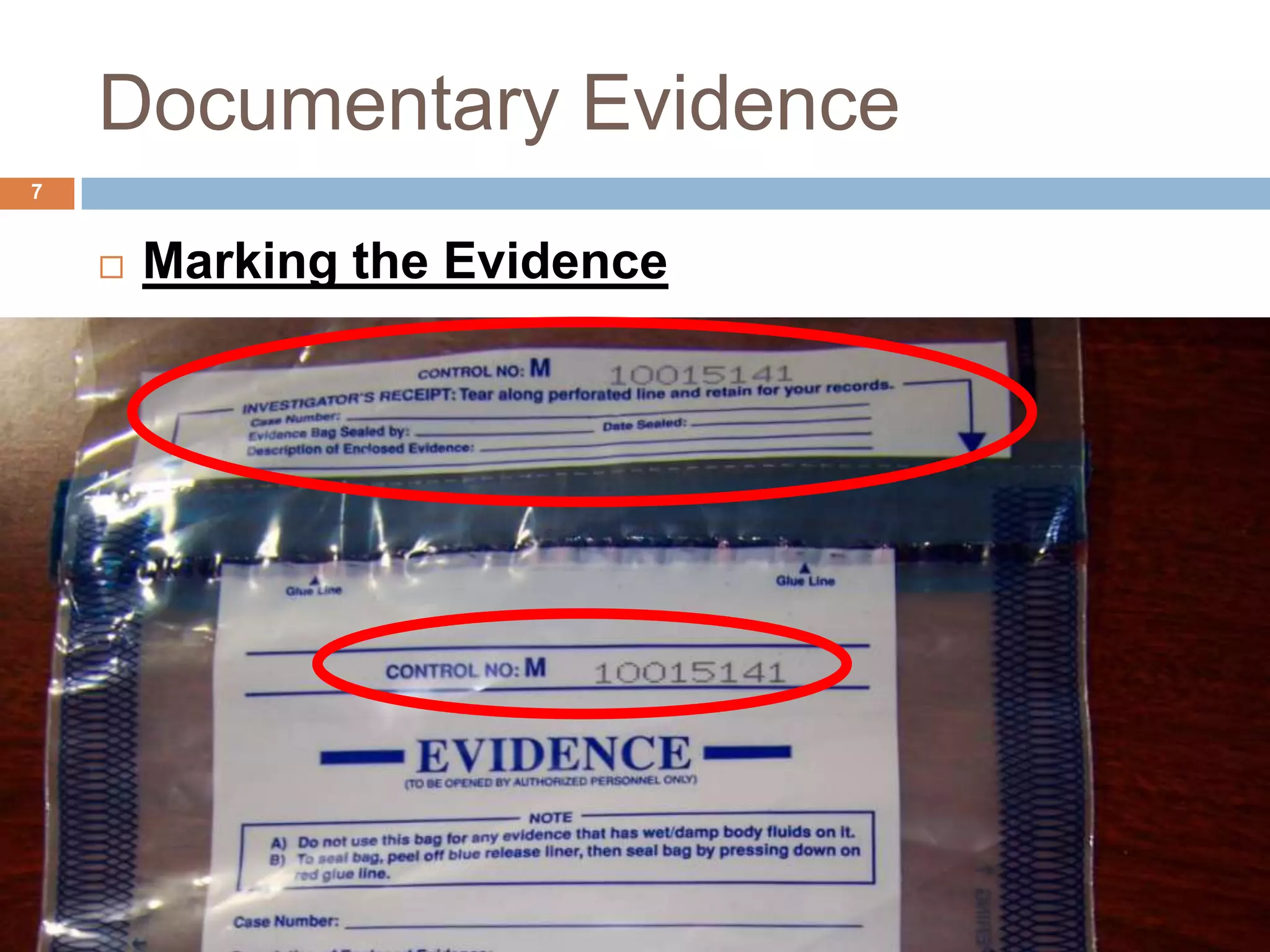

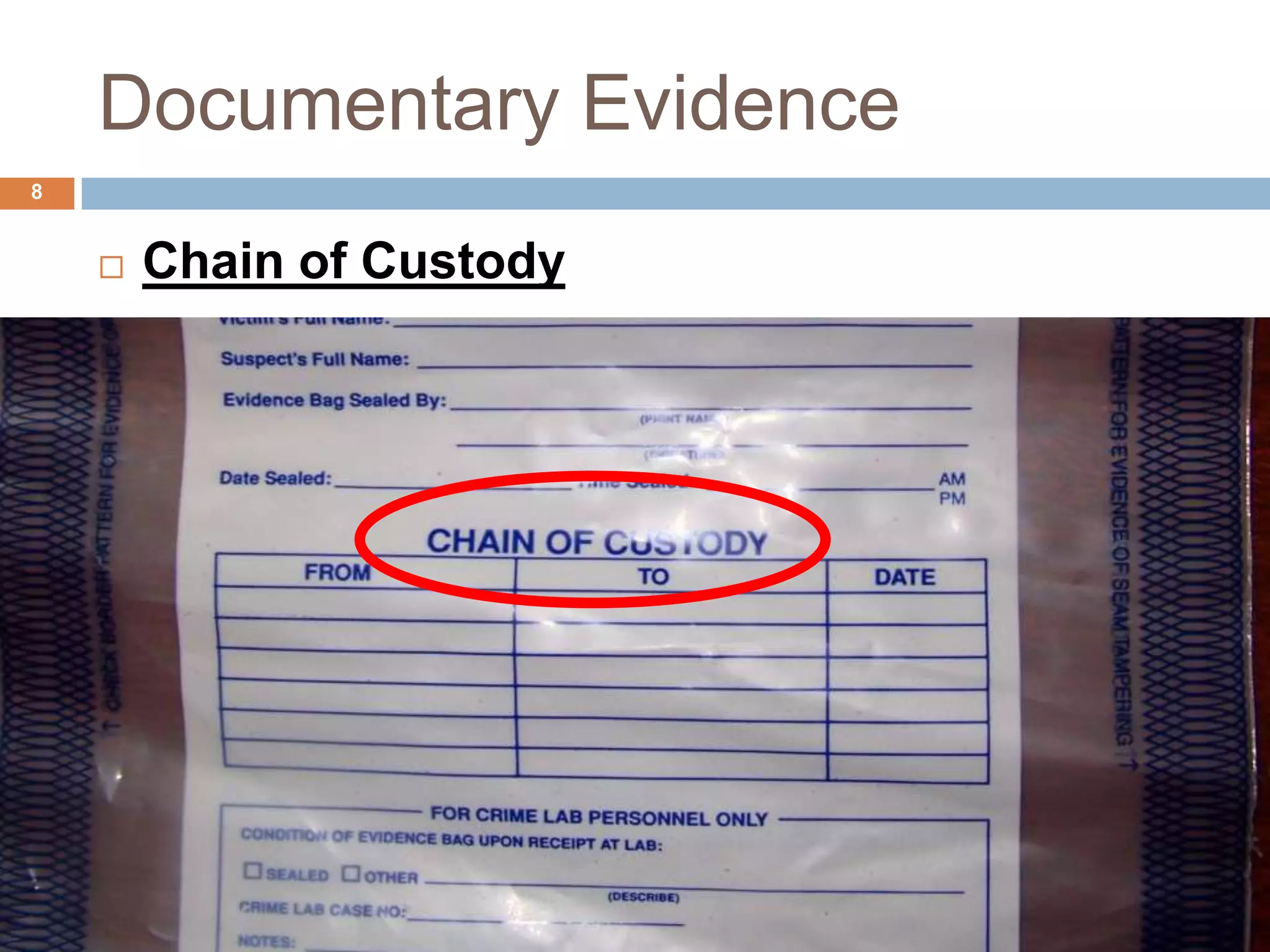

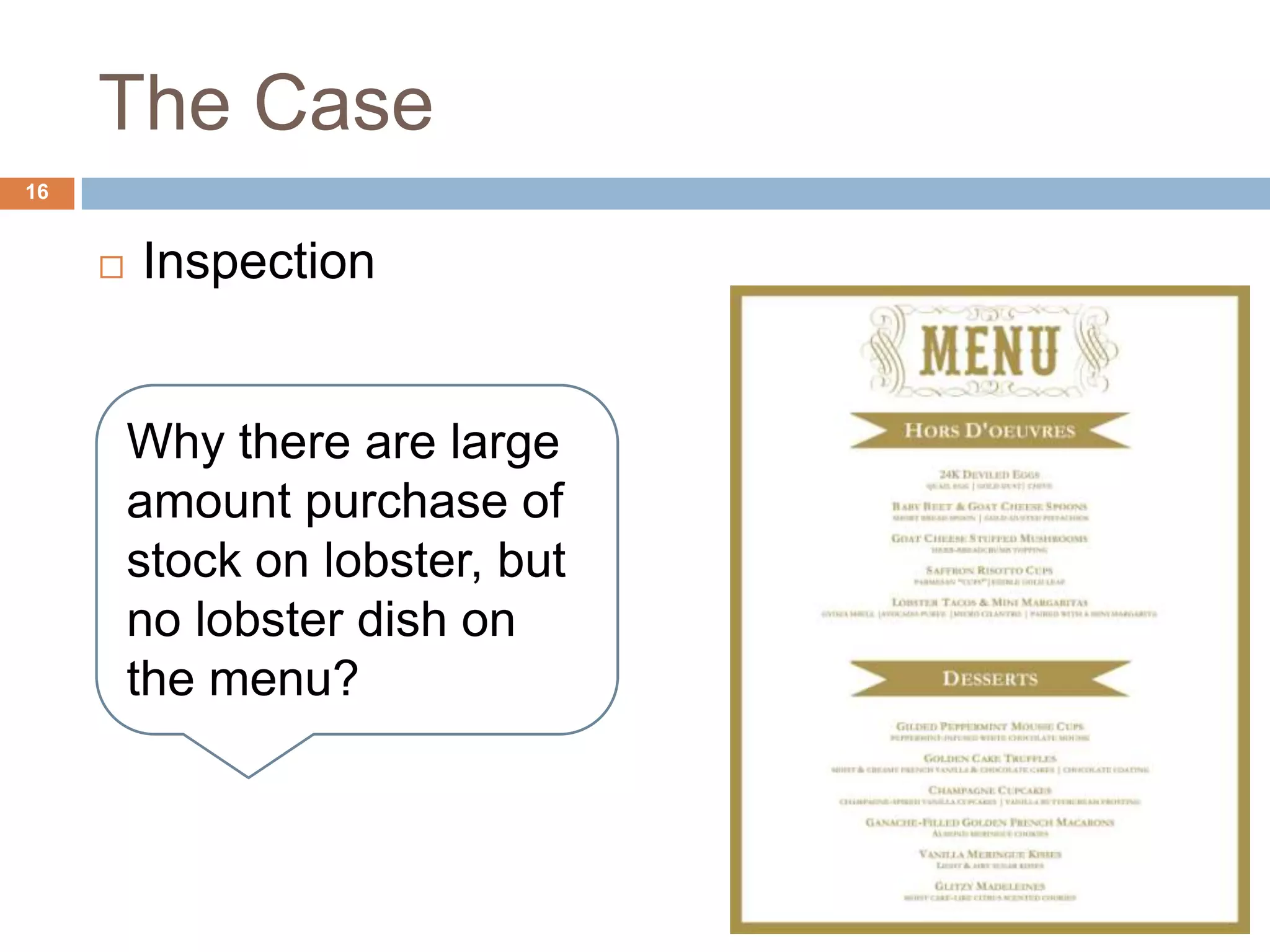

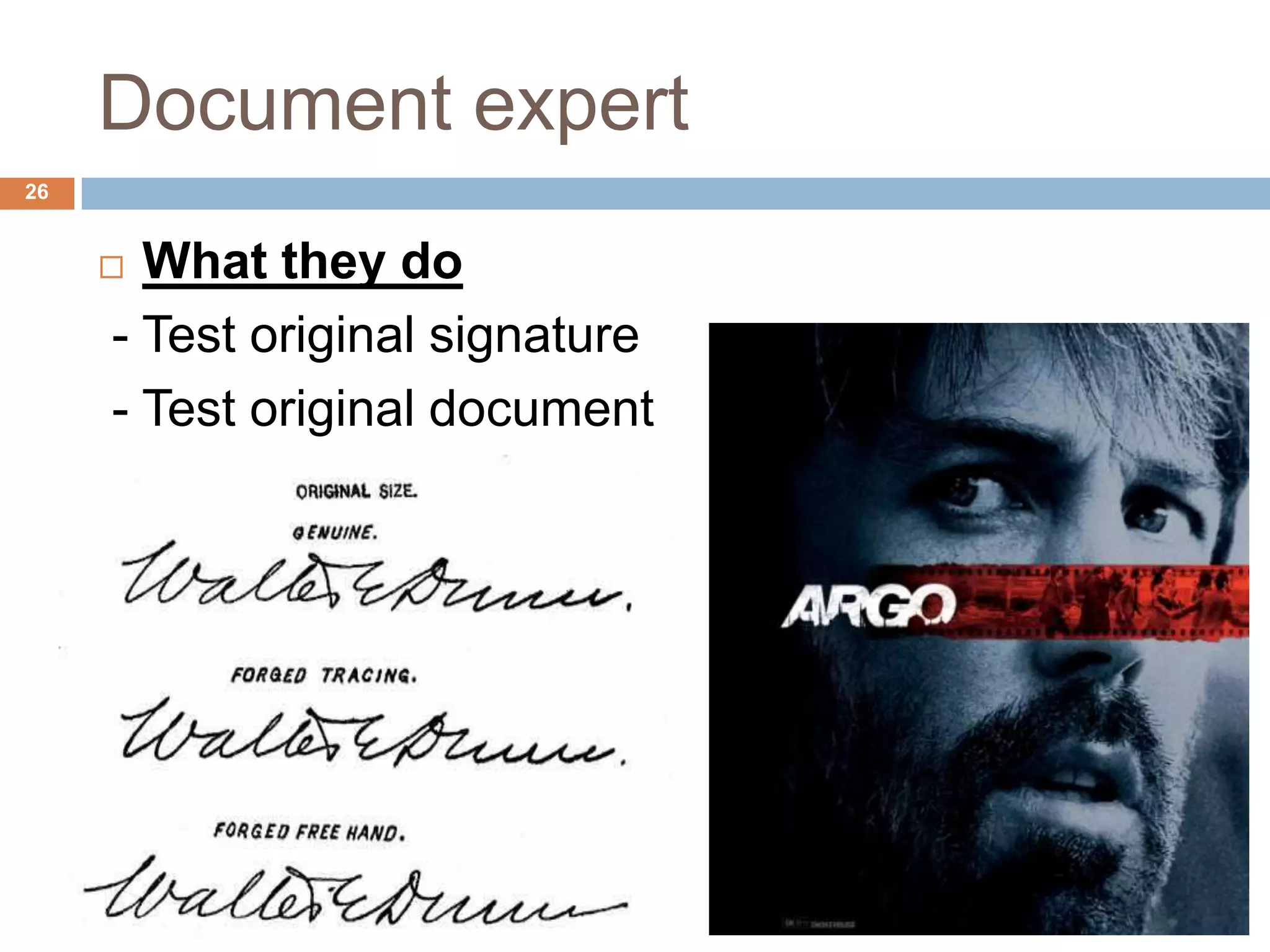

The document discusses investigating concealment through documentary evidence. It outlines obtaining evidence through audit procedures like analytical tests, inquiries, inspections, and confirmations. It provides a case example of an IRD investigation of a restaurant for tax fraud through analyzing financial documents, sampling sales, and questioning the owner. Obtaining hard to access documents may require subpoenas or warrants. Document experts can authenticate signatures and original documents.