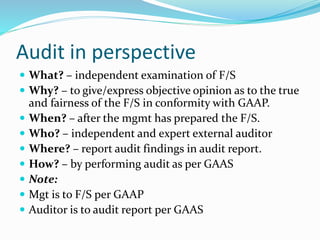

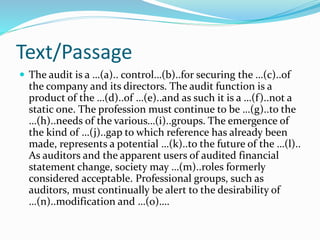

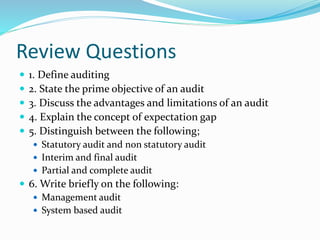

The document provides an overview of the history and concepts of auditing. It discusses how auditors were originally independent arbitrators appointed to hear accounts and provide opinions. It also covers agency theory where shareholders appoint directors as agents to manage companies, and then appoint auditors as secondary agents to report on the directors' stewardship. The objectives of an audit are also summarized as enabling the auditor to provide an independent opinion on whether financial statements are fairly presented in accordance with standards. Key aspects of an audit like compliance, evidence, and the detection of fraud and errors are also briefly discussed.