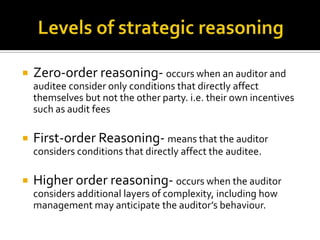

The document discusses Phar-Mor, a company that engaged in accounting fraud to disguise losses and maintain the appearance of success between 1985 and 1992. It provides a framework for detecting financial statement fraud using a "fraud exposure rectangle" examining management, relationships, organization/industry, and financial results. Strategic reasoning considers how fraud perpetrators may conceal fraud and how auditors can modify typical tests to detect concealed schemes.