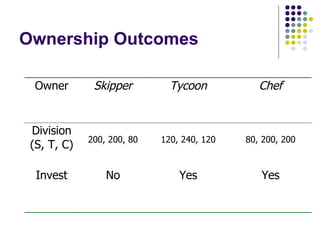

This document discusses vertical integration and how ownership structure impacts incentives. It provides examples of General Motors acquiring Fisher Body and PepsiCo owning bottlers. Vertical integration can improve incentives for relationship-specific investments that are non-contractible by giving the investing party control rights. The optimal ownership structure depends on whose actions are most important for value creation and hardest to encourage through contracts alone.