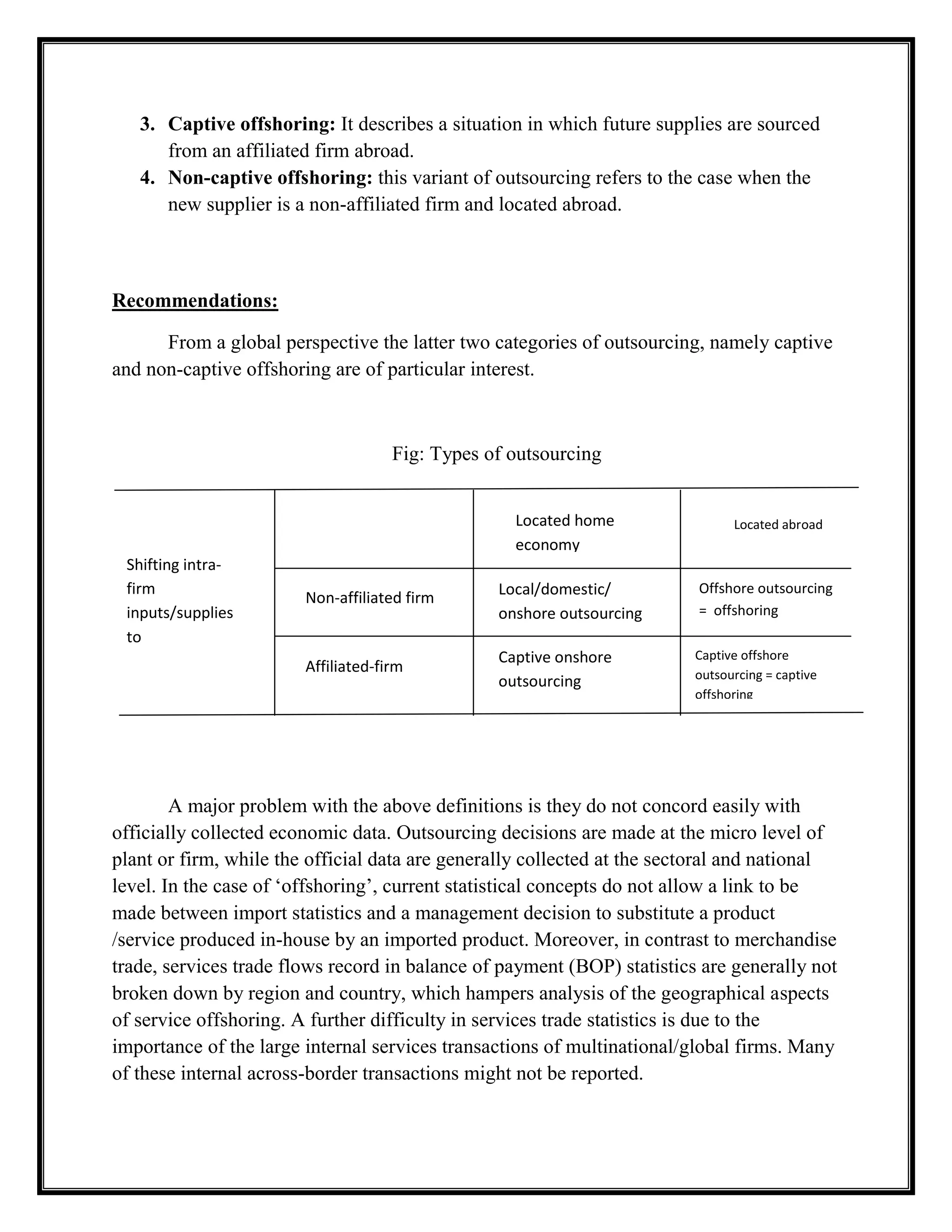

The document discusses global operations and outsourcing strategies used by multinational companies. It identifies four types of outsourcing based on location and firm control: captive onshore, non-captive onshore, captive offshore, and non-captive offshore. Captive offshore outsourcing, referred to as offshoring, moves supplies sourcing to affiliated foreign firms. Offshoring allows companies to lower costs by performing activities in low-cost locations and improving quality control. Total quality management and six sigma programs are approaches used to boost quality and reduce costs throughout global supply chains.