This document discusses various pricing strategies and considerations, including:

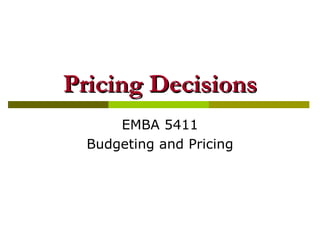

1) It describes different types of pricing such as external pricing, internal transfer pricing, cost-plus pricing, and time and material pricing.

2) It explains concepts like determining the profit-maximizing price using marginal cost and marginal revenue, as well as price elasticity.

3) It outlines factors that influence pricing decisions and different approaches to setting prices like cost-plus markup, variable costing, and absorption costing.

![Time and Material Charges Time Charge per hour = hourly labor cost + annual overhead (excluding material overhead) / annual labor hours + hourly charge to cover profit margin = $18 + ($200,000 / 10,000 hours) + $7 = $ 45 per hour Material Charge formula Material cost incurred on job +[material cost incurred on job *(material handling and storage costs / annual cost of materials used in Repair department)] = material costs incurred on job +[material costs incurred on job ($40,000/$1,000,000)] =1.04 x material costs incurred on job /30 4% of material costs](https://image.slidesharecdn.com/pricingdecisions-110622035112-phpapp02/85/Pricing-decisions-23-320.jpg)