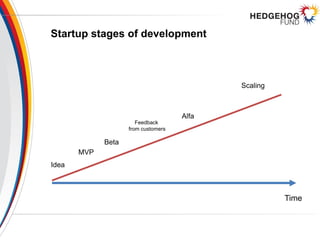

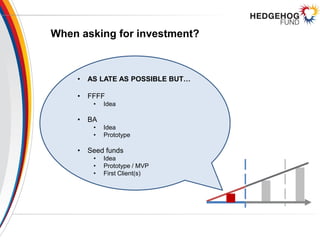

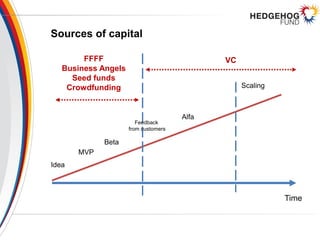

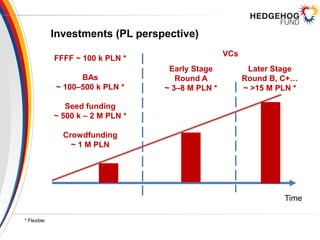

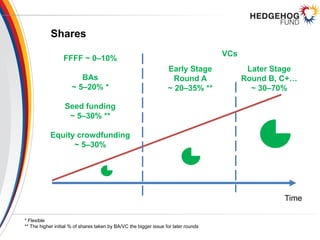

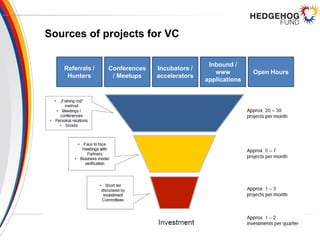

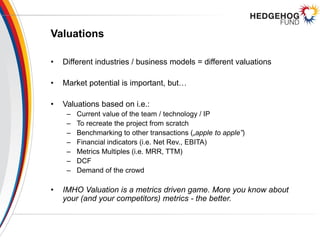

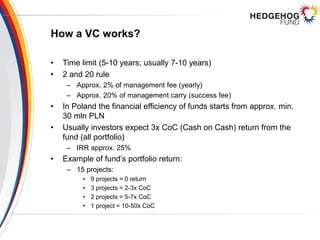

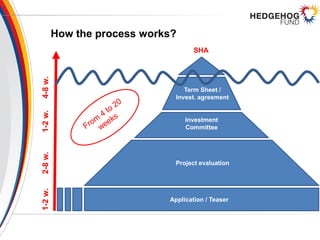

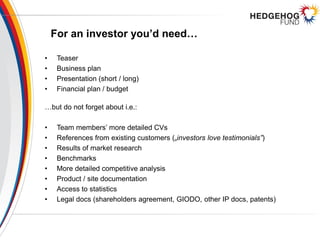

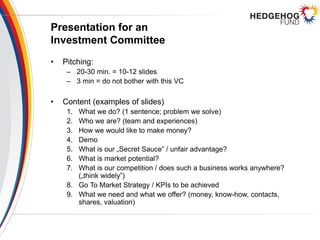

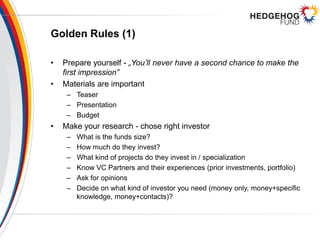

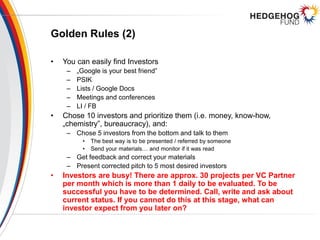

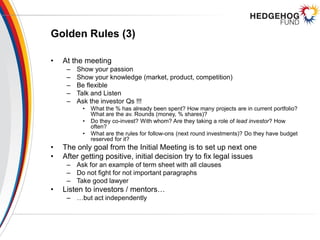

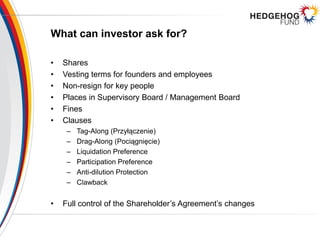

The document provides information for startups on fundraising from venture capital investors in Poland. It discusses the stages of startup development and when it is best to seek investment. Sources of capital at different stages are outlined, including typical investment amounts and share percentages. An overview is given of how venture capital funds operate, how they evaluate projects, and the investment process. Advice is provided on preparing investment materials like a teaser, presentation, and financial plan. Golden rules are outlined for finding investors and having successful investment meetings and negotiations.