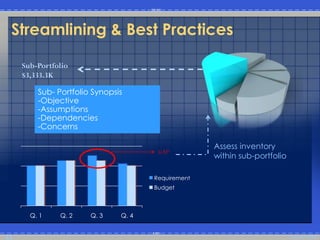

Val Lunz of NASA Goddard Space Flight Center presented best practices for enhancing the Capital Planning Investment Control (CPIC) framework to optimize business portfolio analysis. The CPIC provides a framework to strategically assess IT assets and prioritize investments. Managing the portfolio through sub-portfolios of similar investments and streamlining processes can maximize returns and leverage existing resources. Continuous evaluation and stakeholder involvement are also important to ensure the appropriate investments are selected and controlled in the current fiscal environment.