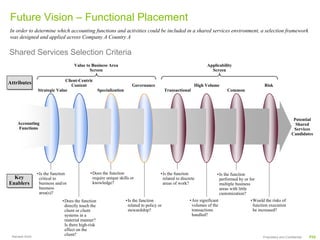

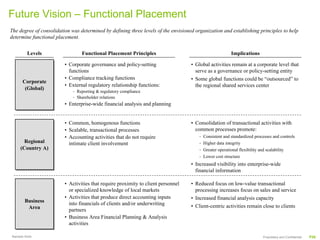

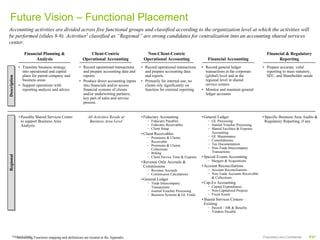

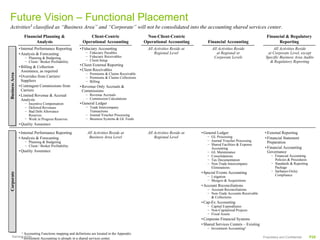

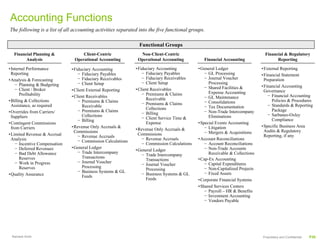

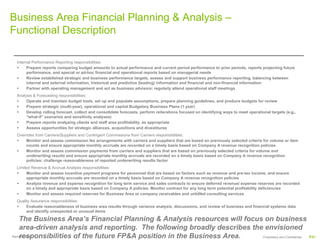

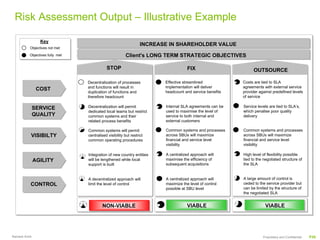

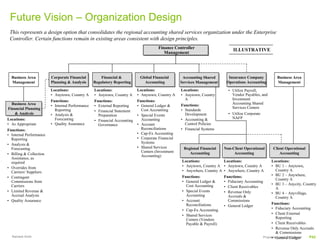

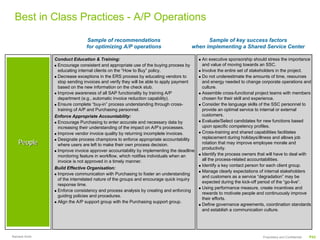

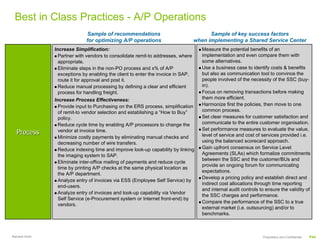

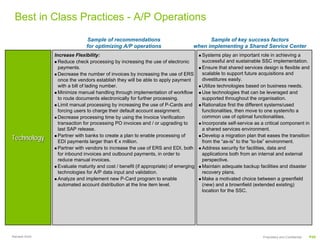

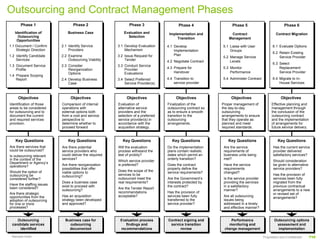

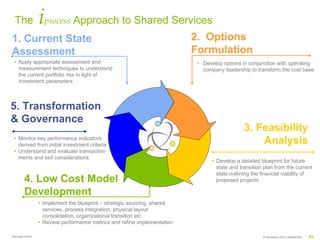

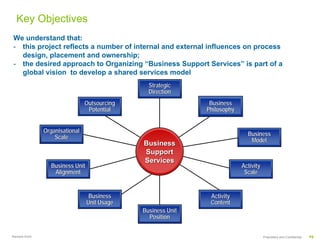

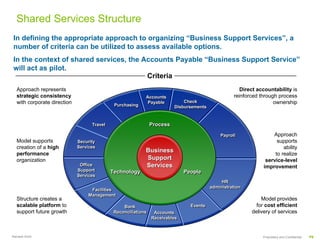

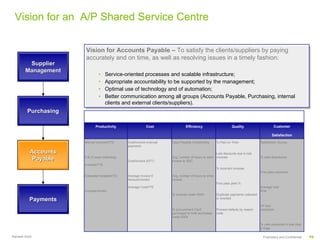

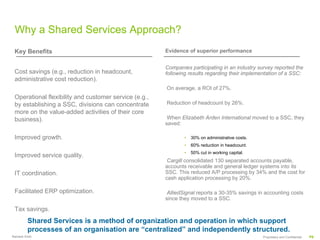

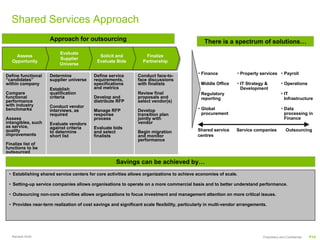

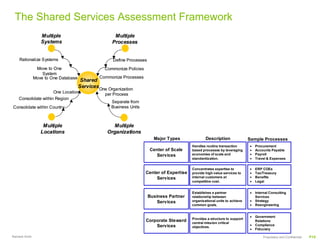

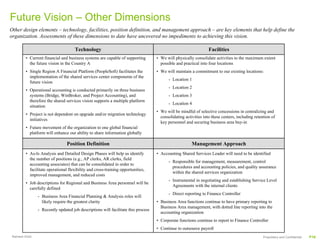

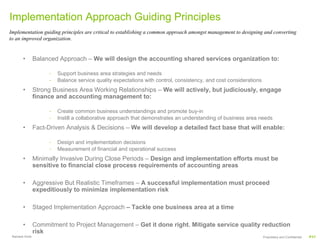

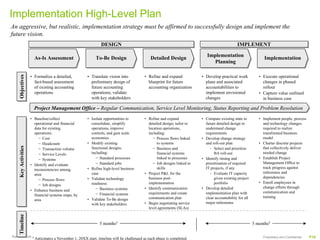

The document discusses creating intelligent and cost-conscious shared services processes. It outlines an approach to shared services that involves assessing the current state, formulating options, conducting feasibility analyses, and developing a low-cost model. Key objectives are discussed such as strategic alignment. A shared services vision and structure is presented using accounts payable as a pilot function. The rationale for a shared services center is described as providing a service-oriented and scalable infrastructure with appropriate accountability.

![Project Organization

Enrolling key stakeholders, business area management and Subject Matter Advisors in the project from design through implementation

will be critical to project success.

Roles & Responsibilities

− CFO −Business Head • Provide active, visible and vocal leadership

Steering Committee

Steering Committee − Controller −[HR]

• Champion Business Area buy-in

− Business Area CFO 1 −[IT]

− Business Area CFO 2 −[Tax] • Execute enterprise-wide communications/ recommendations

Project Sponsor − TBD • Serve as main voice for project – change advocate/ opinion leader

Project Sponsor

• Set overall project direction, set priorities and allocate resources

Project Manager

Project Manager − TBD • Responsible for overall engagement execution and management

• Identify issues & risks and ensure escalation/ resolution

Business Area Teams

Business Area Teams Program Management

• Support Team Leads in project planning and delivery

• Track status and manage issue identification and resolution

BU 1

BU 1 • Design and deliver change management programs

Team Rosters:

BU 2

BU 2 − 1.0 Team Lead

Team Leads

• Manage collection and synthesis of data, internal benchmarks, and design elements

− X.0 Business Area Lead

BU 3

BU 3 − X.0 Analysts • Facilitate meetings with key executives, business areas, and functional teams

Program

Program − TBD SMAs • Participate in site visits, planning sessions and development of deliverables

Management Office

Management Office BU 4

BU 4 • Skill set needs: Operational performance improvement; Accounting process redesign;

Benchmarking study design and execution; Implementation planning; Strong oral and

BU 5

BU 5 written skills; Visioning Sessions; and Group facilitation

Business Area Leads

Other

Other • Act as liaison with represented Business Area

Tax Team

Tax Team • Deep business area/ technical knowledge and familiarity with its accounting roles

Human Resources/

Human Resources/ • Participate in data gathering, visioning, and planning

− 1.0 Team Lead

− TBD SMAs Facilities Team

Facilities Team Analysts

− 1.0 Team Lead • Perform selected benchmarking, business case, process & organization analysis

− X.0 Analysts activities

Treasury Team

Treasury Team − TBD SMAs • Assist with deliverable development

− 1.0 Team Lead Subject Matter Advisors (SMAs)

− TBD SMAs Technology Team • Help anticipate, identify and resolve issues

Technology Team • Provide accounting and shared services center subject matter expertise and support,

− 1.0 Team Lead as needed

− X.0 Analysts • Reference applicable best practices

− TBD SMAs

Ramesh Krish Proprietary and Confidential P19](https://image.slidesharecdn.com/iprocessframeworksharedservices-100315172635-phpapp01/85/I-process-framework-shared-services-20-320.jpg)