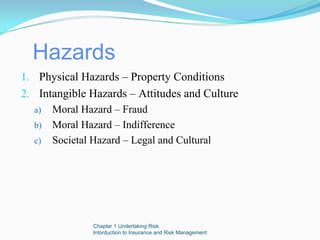

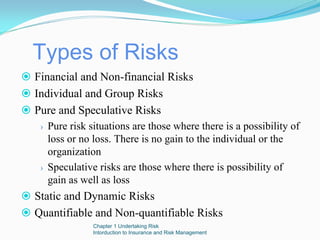

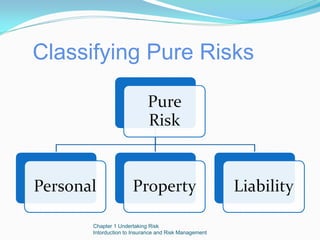

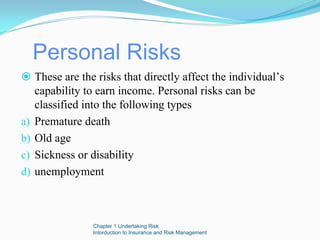

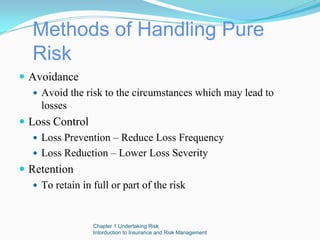

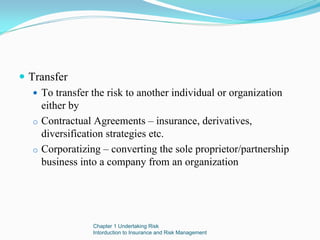

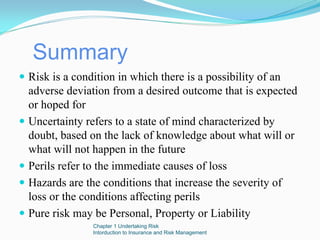

The document outlines the concept of risk, distinguishing between risk and uncertainty, and defines various types of risks, including personal, property, and liability risks. It discusses methods for managing pure risk, such as avoidance, loss control, retention, and transfer through contractual agreements. Additionally, it categorizes hazards impacting loss severity and provides insight into pure and speculative risks.