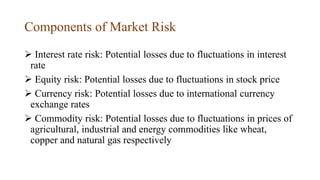

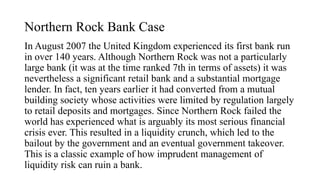

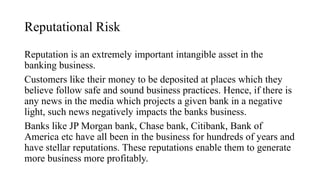

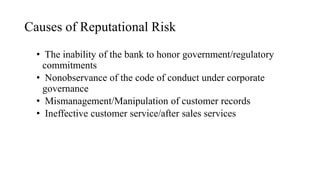

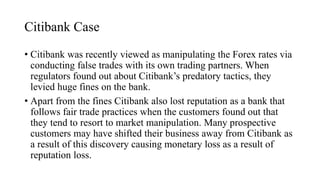

Banks face numerous risks that must be carefully managed. The document outlines several key risks faced by banks: credit risk from loan defaults, market risk from changes in market prices, operational risk from failed internal processes, liquidity risk from inability to fund operations, and reputational risk from negative publicity. It also provides examples of how specific banks like Northern Rock and Barings faced risks that ultimately led to losses or collapse without proper risk mitigation. Effective risk management requires banks to identify, assess, prioritize and control risks, as well as purchase insurance and diversify their portfolios.