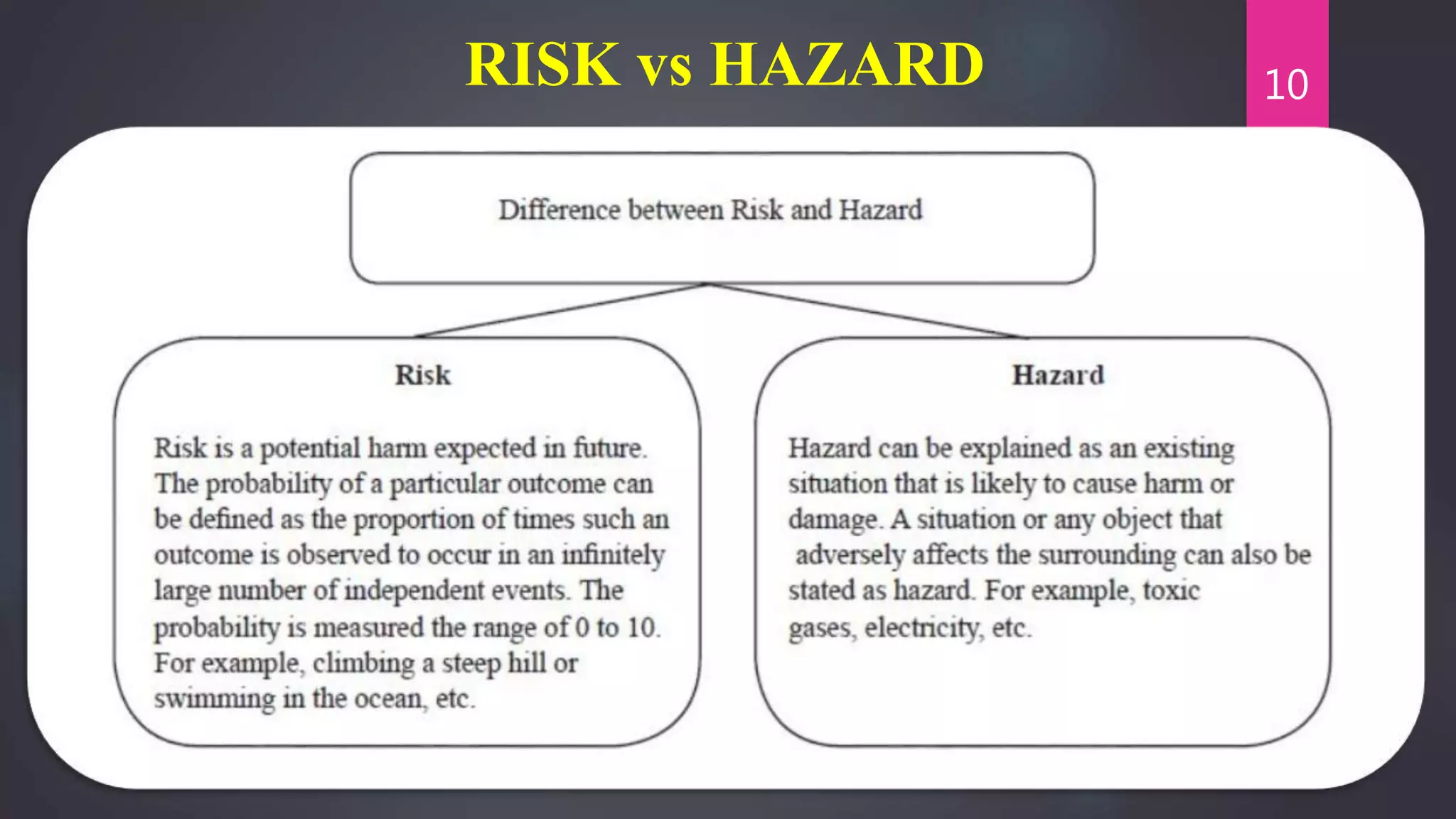

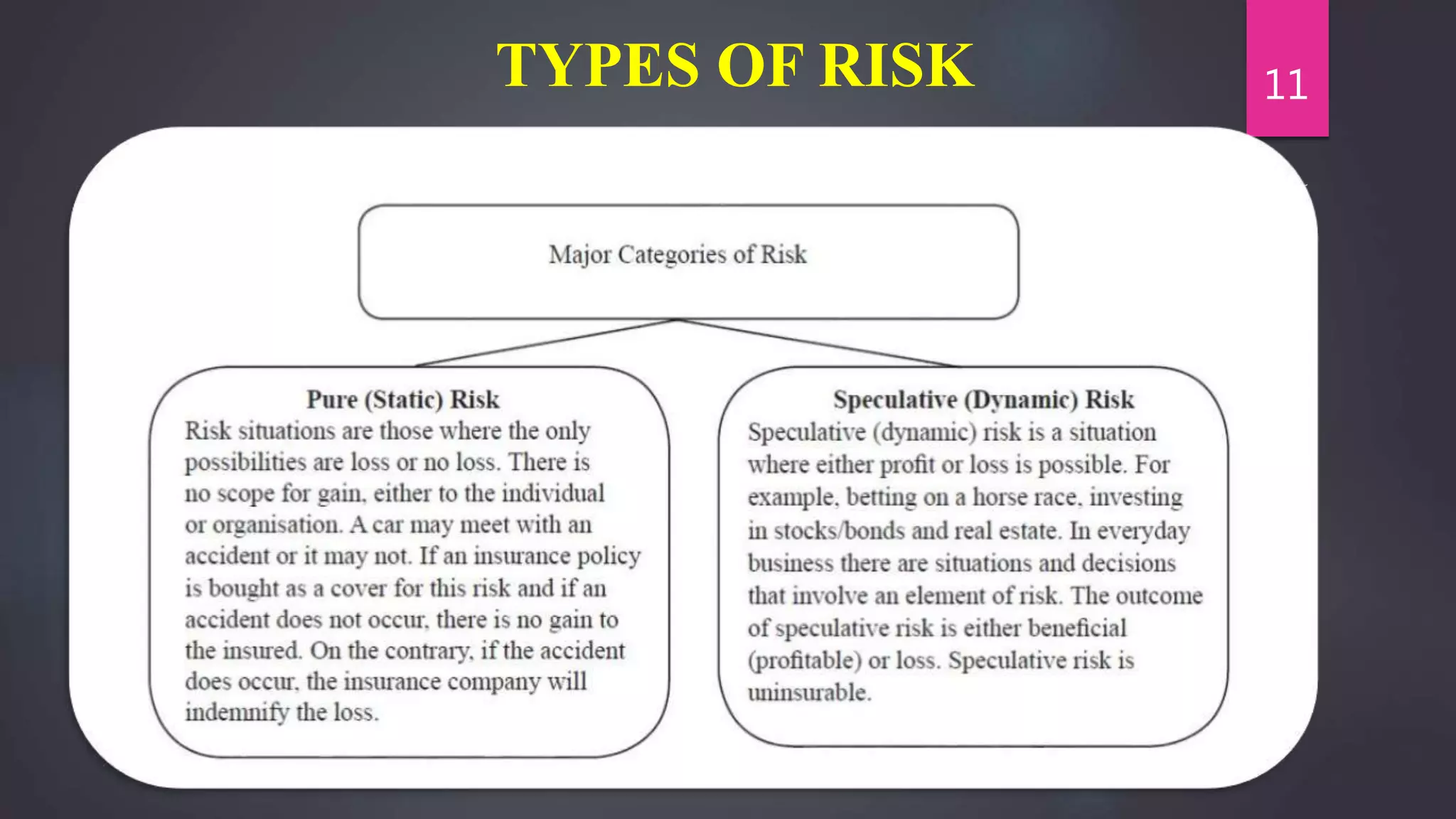

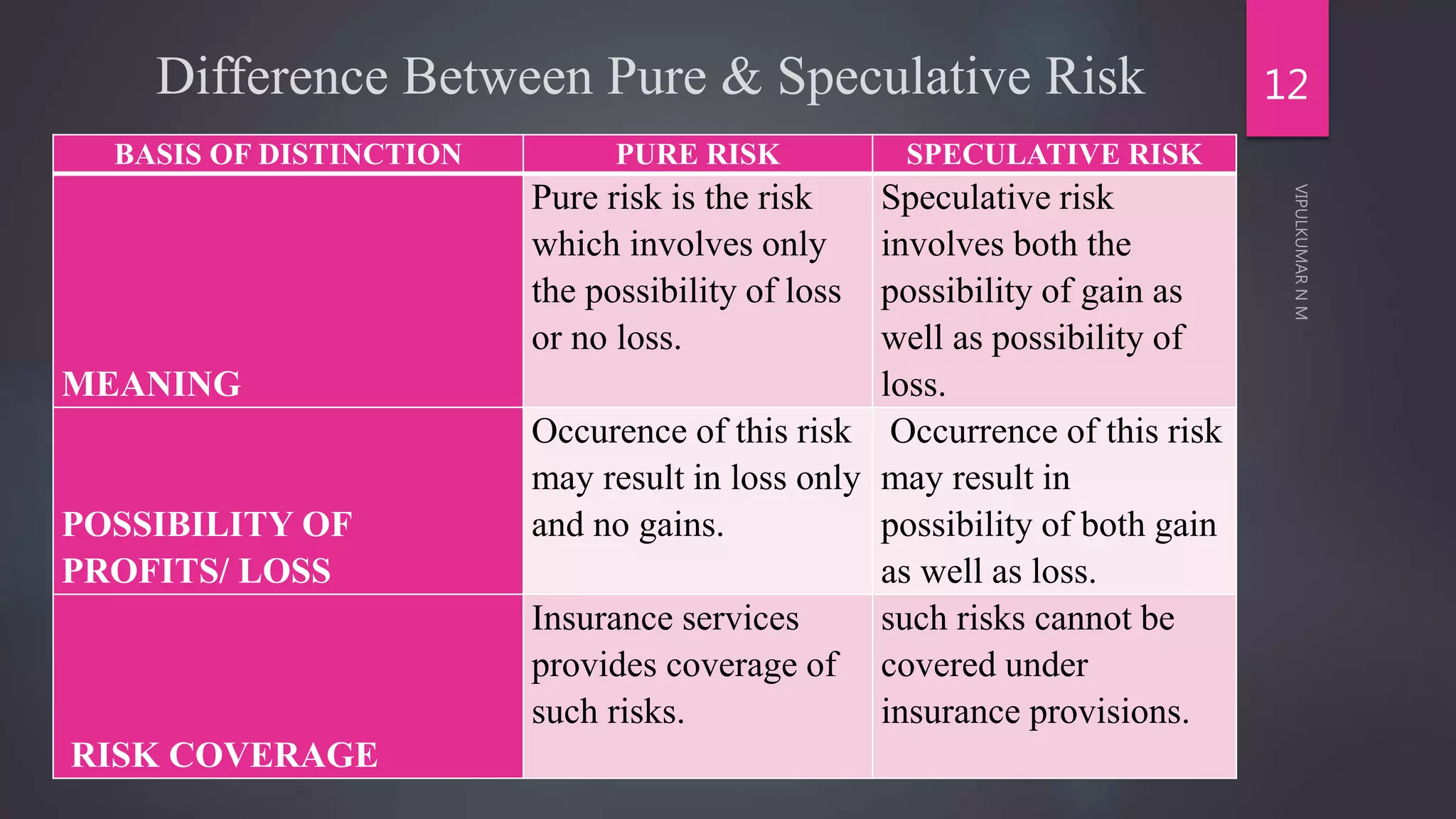

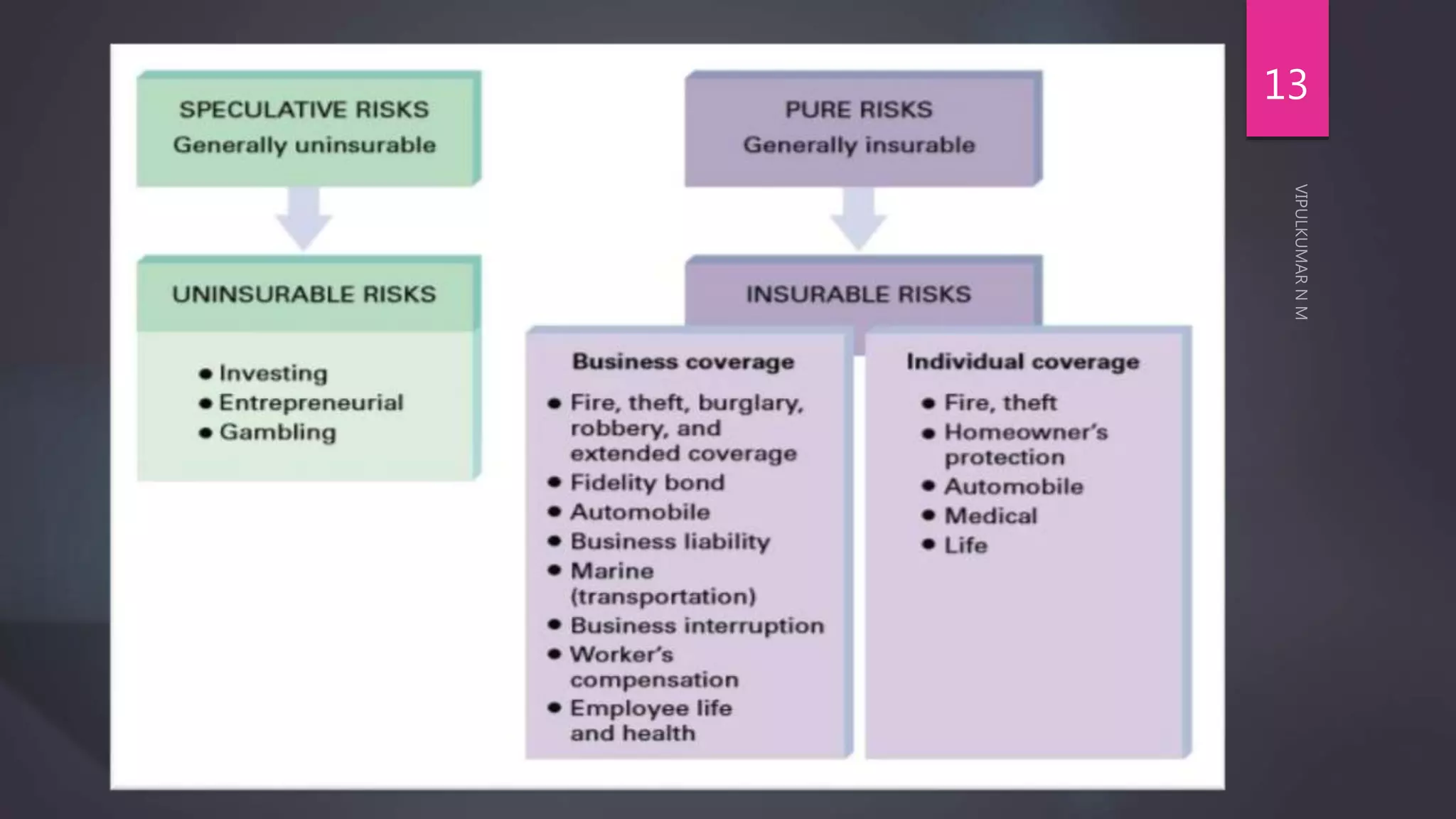

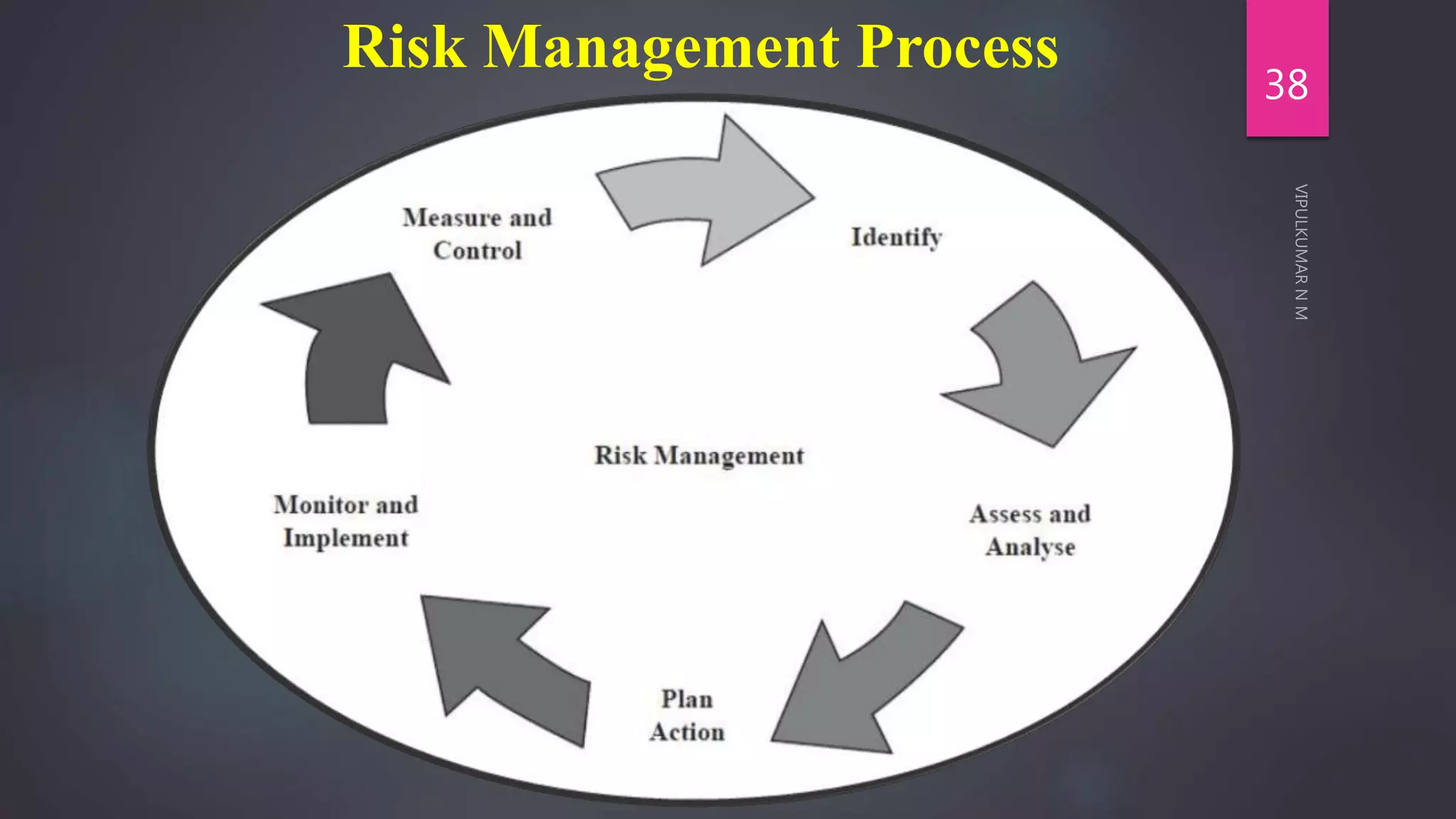

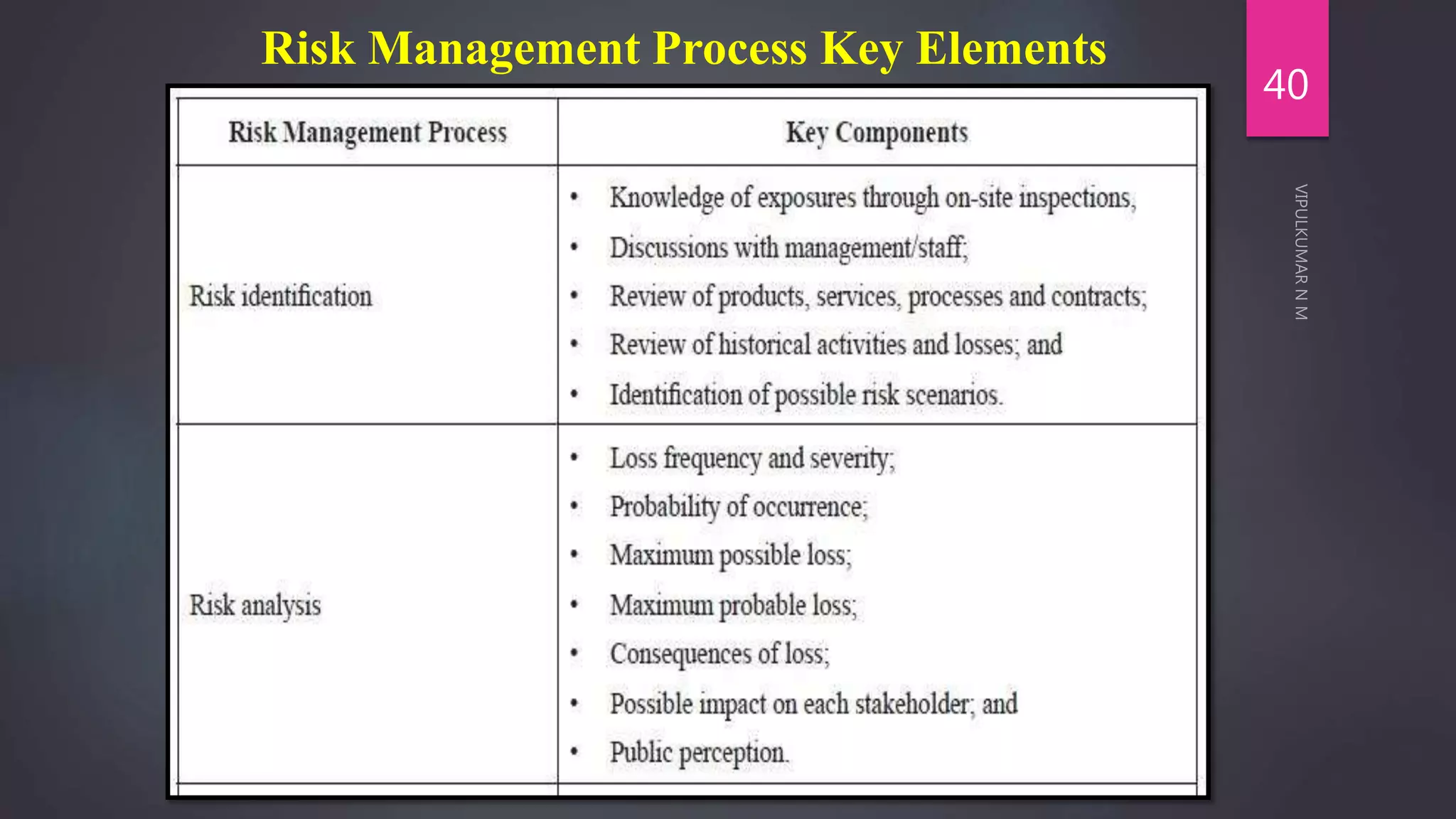

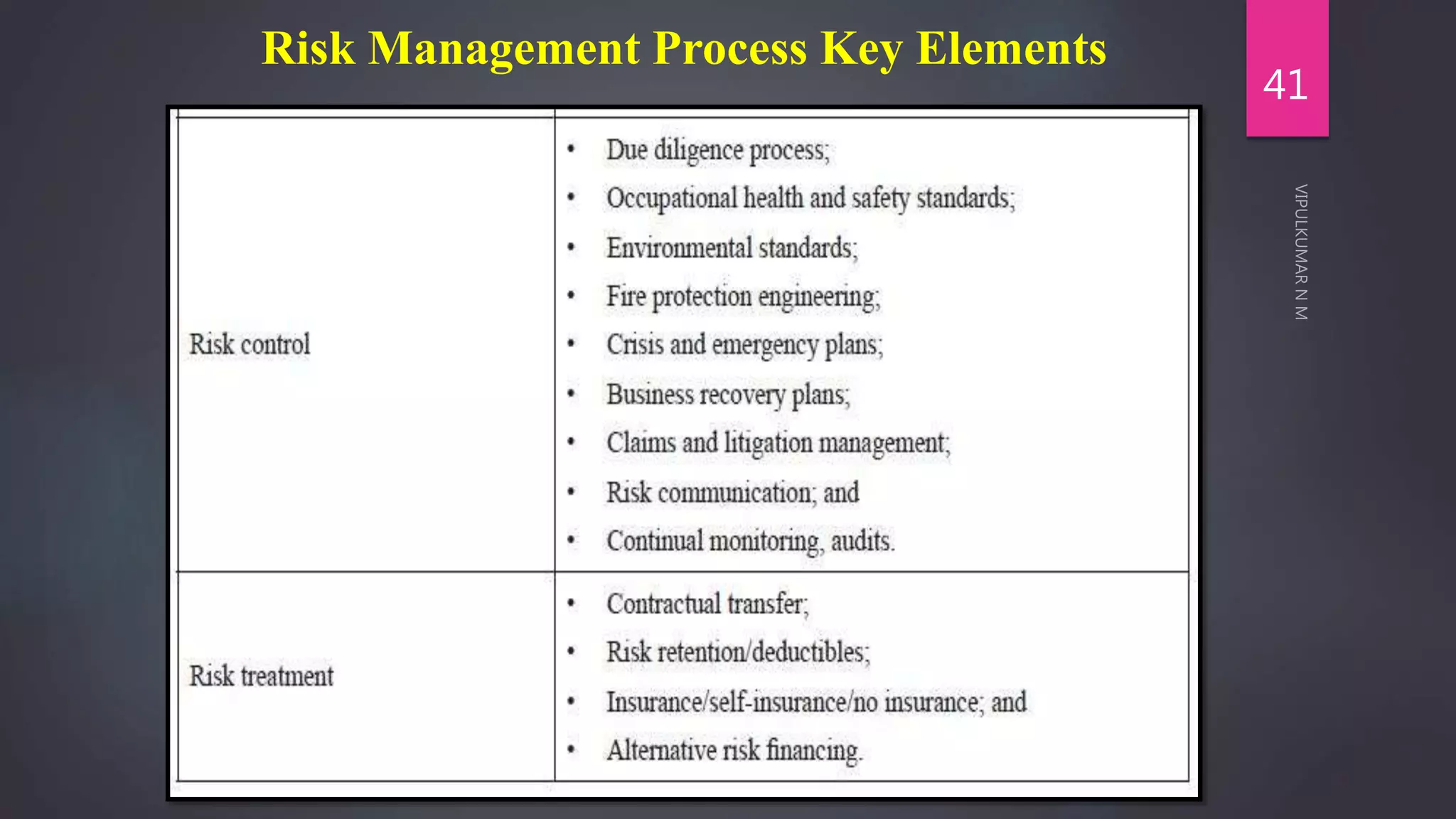

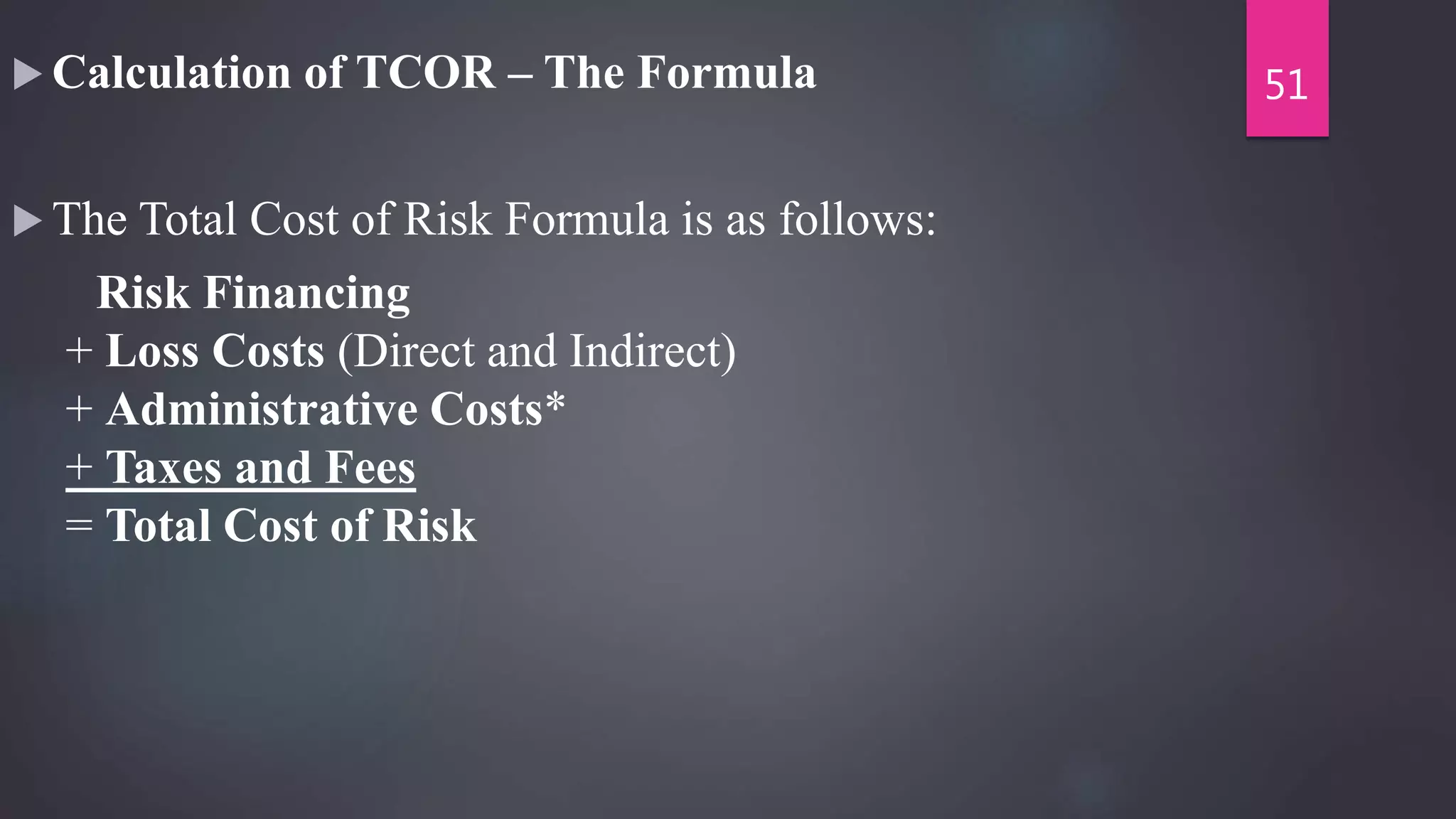

The document provides a comprehensive overview of risk management, defining key terms such as risk, peril, and hazard, and distinguishing between types of risk, including pure and speculative risks. It outlines the risk management process, which involves identifying, assessing, and managing risks to reduce losses, and discusses the components and calculation of the total cost of risk. Additionally, it highlights various types of risks and their implications for individuals and organizations, emphasizing the importance of risk management in business strategy.