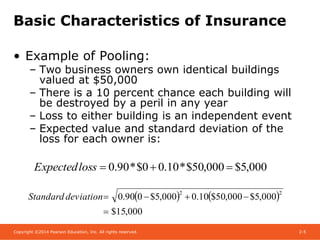

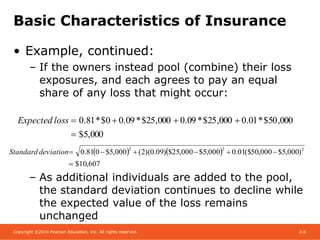

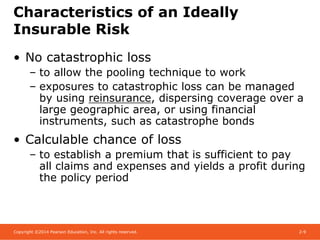

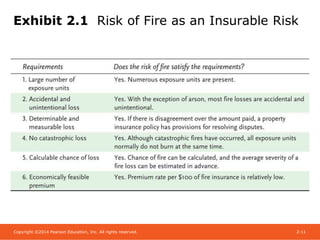

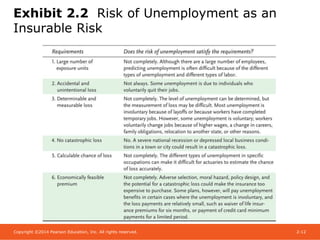

This document provides an overview of insurance and risk. It defines insurance as the pooling of fortuitous losses among a group to spread risk. Key points covered include the characteristics of an insurable risk, how insurance differs from gambling and hedging, the types of private and government insurance, and the social benefits and costs of insurance.