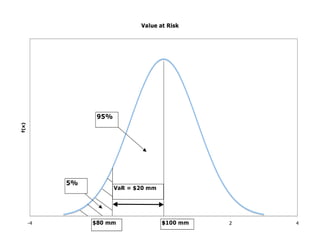

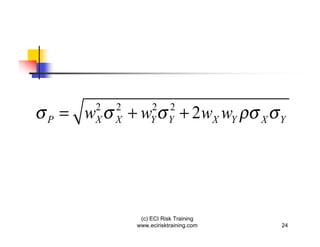

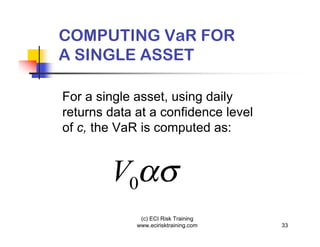

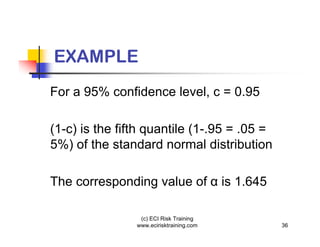

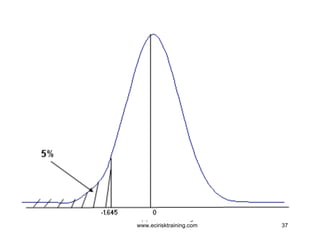

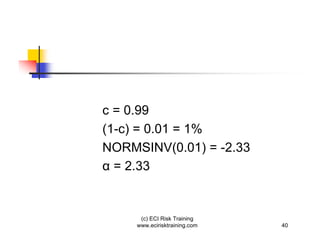

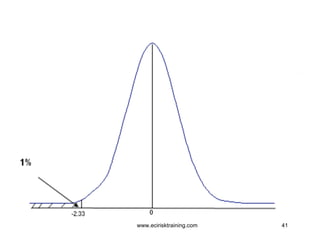

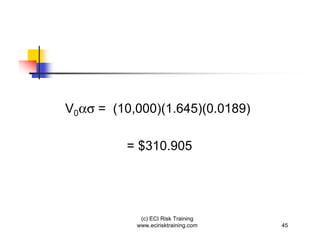

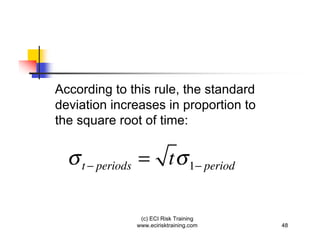

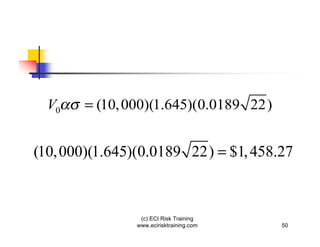

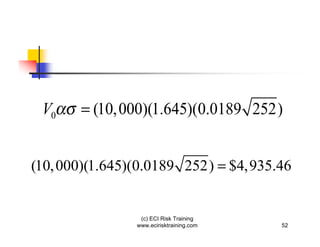

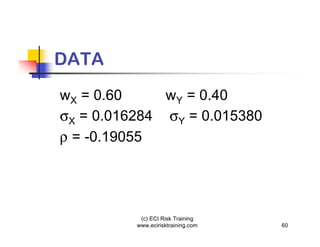

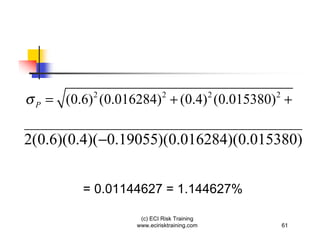

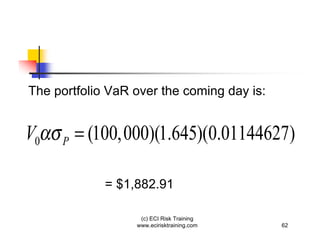

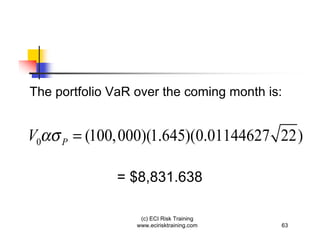

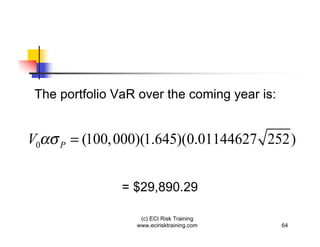

Value at Risk (VaR) is a statistical technique used to measure potential portfolio losses over a specified time period and confidence level. It was originally used to measure market risk but has been extended to other risk types like credit and operational risk. VaR calculates the maximum dollar amount a portfolio could lose with a given level of confidence, usually 95%. Lower correlations between assets in a portfolio reduce overall risk. VaR is computed using weights, volatilities, and correlations of assets in a portfolio along with the confidence level and time horizon.